Page 110 - DMGT409Basic Financial Management

P. 110

Unit 6: Capital Structure Theory

Solution: Notes

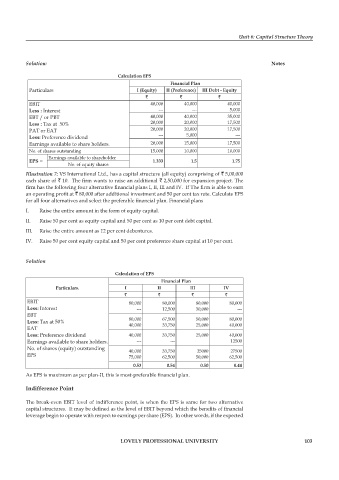

Calculation EPS

Financial Plan

Particulars I (Equity) II (Preference) III Debt - Equity

` ` `

EBIT 40,000 40,000 40,000

Less : Interest --- --- 5,000

EBT / or PBT 40,000 40,000 35,000

Less : Tax at 50% 20,000 20,000 17,500

PAT or EAT 20,000 20,000 17,500

Less: Preference dividend --- 5,000 ---

Earnings available to share holders. 20,000 15,000 17,500

No. of shares outstanding 15,000 10,000 10,000

Earnings available to shareholder

EPS = 1.333 1.5 1.75

No. of equity shares

Illustration 7: VS International Ltd., has a capital structure (all equity) comprising of ` 5,00,000

each share of ` 10. The firm wants to raise an additional ` 2,50,000 for expansion project. The

firm has the following four alternative financial plans I, II, III and IV. If The firm is able to earn

an operating profi t at ` 80,000 after additional investment and 50 per cent tax rate. Calculate EPS

for all four alternatives and select the preferable financial plan. Financial plans

I. Raise the entire amount in the form of equity capital.

II. Raise 50 per cent as equity capital and 50 per cent as 10 per cent debt capital.

III. Raise the entire amount as 12 per cent debentures.

IV. Raise 50 per cent equity capital and 50 per cent preference share capital at 10 per cent.

Solution

Calculation of EPS

Financial Plan

Particulars. I II III IV

` ` ` `

EBIT 80,000 80,000 80,000 80,000

Less: Interest --- 12,500 30,000 ---

EBT

Less: Tax at 50% 80,000 67,500 50,000 80,000

40,000

40,000

25,000

33,750

EAT

Less: Preference dividend 40,000 33,750 25,000 40,000

Earnings available to share holders. --- --- 12500

No. of shares (equity) outstanding 40,000 33,750 25000 27500

EPS 75,000 62,500 50,000 62,500

0.53 0.54 0.50 0.44

As EPS is maximum as per plan-II, this is most-preferable fi nancial plan.

Indifference Point

The break-even EBIT level of indifference point, is when the EPS is same for two alternative

capital structures. It may be defined as the level of EBIT beyond which the benefi ts of fi nancial

leverage begin to operate with respect to earnings per share (EPS). In other words, if the expected

LOVELY PROFESSIONAL UNIVERSITY 103