Page 197 - DMGT104_FINANCIAL_ACCOUNTING

P. 197

Debit

( )

( )

Land and Buildings

50,000

Purchases

40,000

Stock

2,500

Returns

1,500

10,000

Wages

9,000

Salaries

Office expenses Ledger Accounts 1,10,000 Credit

2,400

Carriage inwards 1,200

Carriage outwards 2,000

Discounts 750 1,200

Bad debts 1,200

Unit 8: Financial Statements

Sales 2,05,000

Capital account 1,30,000

Insurance 1,500

Commission 1,500 Notes

Plant and Machinery 50,000

Furniture and Fixtures 10,000

Bills Receivable 20,000

Sundry debtors and creditors 40,000 25,000

Cash in hand 1,500

Cash at bank 4,500

Office equipment 12,000

Bills payable 2,350

Total 3,67,550 3,67,550

Adjustments:

(a) Closing stock amounted to 60,000.

(b) Outstanding liabilities: Wages 2,000, Rent 3,000.

(c) Depreciate land and buildings at 5%, plant and machinery, office equipment and furniture

and fixtures at 10%.

(d) Insurance premium prepaid to the extent of 200.

Solution:

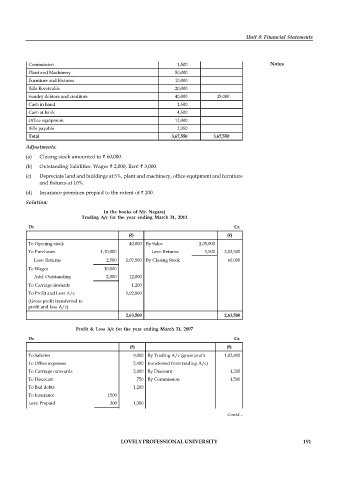

In the books of Mr. Nagaraj

Trading A/c for the year ending March 31, 2011

Dr. Cr.

( ) ( )

To Opening stock 40,000 By Sales 2,05,000

To Purchases 1,10,000 Less: Returns 1,500 2,03,500

Less: Returns 2,500 1,07,500 By Closing Stock 60,000

To Wages 10,000

Add: Outstanding 2,000 12,000

To Carriage inwards 1,200

To Profit and Loss A/c 1,02,800

(Gross profit transferred to

profit and loss A/c)

2,63,500 2,63,500

Profit & Loss A/c for the year ending March 31, 2007

Dr. Cr.

( ) ( )

To Salaries 9,000 By Trading A/c (gross profit 1,02,800

To Office expenses 2,400 transferred from trading A/c)

To Carriage outwards 2,000 By Discount 1,200

To Discount 750 By Commission 1,500

To Bad debts 1,200

To Insurance 1500

Less: Prepaid 200 1,300

To Outstanding rent 3,000

Contd...

To Depreciation:

Land and Buildings 2,500

Plant and Machinery 5,000

LOVELY PROFESSIONAL UNIVERSITY 191

Furniture & Fixture 1,000

Office equipment 1,200 9,700

To Capital A/c 76,150

(Net Profit transferred)

1,05,500 1,05,500