Page 230 - DMGT104_FINANCIAL_ACCOUNTING

P. 230

Financial Accounting

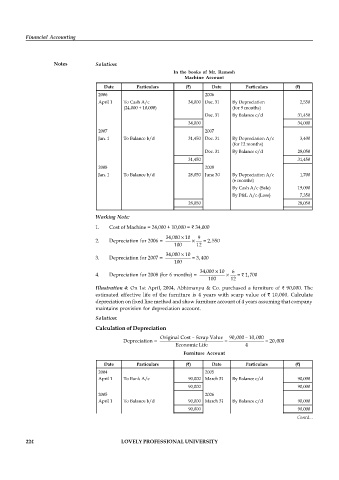

Notes Solution:

In the books of Mr. Ramesh

Machine Account

Date Particulars ( ) Date Particulars ( )

2006 2006

April 1 To Cash A/c 34,000 Dec. 31 By Depreciation 2,550

(24,000 + 10,000) (for 9 months)

Dec. 31 By Balance c/d 31,450

34,000 34,000

2007 2007

Jan. 1 To Balance b/d 31,450 Dec. 31 By Depreciation A/c 3,400

(for 12 months)

Dec. 31 By Balance c/d 28,050

31,450 31,450

2008 2008

Jan. 1 To Balance b/d 28,050 June 30 By Depreciation A/c 1,700

(6 months)

By Cash A/c (Sale) 19,000

By P&L A/c (Loss) 7,350

28,050 28,050

Working Note:

1. Cost of Machine = 24,000 + 10,000 = 34,000

34,000 ´ 10 9

2. Depreciation for 2006 = ´ = 2,550

100 12

34,000 ´ 10

3. Depreciation for 2007 = = 3,400

100

34,000 ´ 10 6

4. Depreciation for 2008 (for 6 months) = ´ = 1,700

100 12

Illustration 4: On 1st April, 2004, Abhimanyu & Co. purchased a furniture of 90,000. The

estimated effective life of the furniture is 4 years with scarp value of 10,000. Calculate

depreciation on fixed line method and show furniture account of 4 years assuming that company

maintains provision for depreciation account.

Solution:

Calculation of Depreciation

Original Cost – Scrap Value 90,000 – 10,000

Depreciation = = = 20,000

Economic Life 4

Furniture Account

Date Particulars ( ) Date Particulars ( )

2004 2005

April 1 To Bank A/c 90,000 March 31 By Balance c/d 90,000

90,000 90,000

2005 2006

April 1 To Balance b/d 90,000 March 31 By Balance c/d 90,000

90,000 90,000

2006 2007 Contd...

April 1 To Balance b/d 90,000 March 31 By Balance b/d 90,000

90,000 90,000

2007 2008

224 LOVELY PROFESSIONAL UNIVERSITY

April 1 To Balance b/d 90,000 March 31 By Provision for

Depreciation A/c 80,000

By Balance c/d 10,000

90,000 90,000