Page 255 - DMGT104_FINANCIAL_ACCOUNTING

P. 255

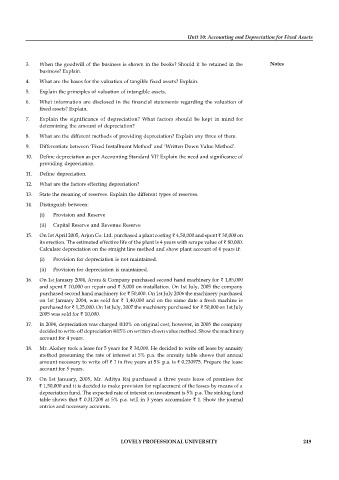

Unit 10: Accounting and Depreciation for Fixed Assets

3. When the goodwill of the business is shown in the books? Should it be retained in the Notes

business? Explain.

4. What are the bases for the valuation of tangible fixed assets? Explain.

5. Explain the principles of valuation of intangible assets.

6. What information are disclosed in the financial statements regarding the valuation of

fixed assets? Explain.

7. Explain the significance of depreciation? What factors should be kept in mind for

determining the amount of depreciation?

8. What are the different methods of providing depreciation? Explain any three of them.

9. Differentiate between ‘Fixed Installment Method’ and ‘Written Down Value Method’.

10. Define depreciation as per Accounting Standard VI? Explain the need and significance of

providing depreciation.

11. Define depreciation.

12. What are the factors effecting depreciation?

13. State the meaning of reserves. Explain the different types of reserves.

14. Distinguish between:

(i) Provision and Reserve

(ii) Capital Reserve and Revenue Reserve

15. On 1st April 2005, Arjun Co. Ltd. purchased a plant costing 4,50,000 and spent 30,000 on

its erection. The estimated effective life of the plant is 4 years with scrape value of 80,000.

Calculate depreciation on the straight line method and show plant account of 4 years if:

(i) Provision for depreciation is not maintained.

(ii) Provision for depreciation is maintained.

16. On 1st January 2004, Arora & Company purchased second hand machinery for 1,85,000

and spent 10,000 on repair and 5,000 on installation. On 1st July, 2005 the company

purchased second hand machinery for 50,000. On 1st July 2006 the machinery purchased

on 1st January 2004, was sold for 1,40,000 and on the same date a fresh machine is

purchased for 1,25,000. On 1st July, 2007 the machinery purchased for 50,000 on 1st July

2005 was sold for 10,000.

17. In 2004, depreciation was charged @10% on original cost, however, in 2005 the company

decided to write-off depreciation @15% on written-down value method. Show the machinery

account for 4 years.

18. Mr. Akshey took a lease for 5 years for 30,000. He decided to write off lease by annuity

method presuming the rate of interest at 5% p.a. the annuity table shows that annual

amount necessary to write off 1 in five years at 5% p.a. is 0.230975. Prepare the lease

account for 5 years.

19. On 1st January, 2005, Mr. Aditya Raj purchased a three years lease of premises for

1,50,000 and it is decided to make provision for replacement of the losses by means of a

depreciation fund. The expected rate of interest on investment is 5% p.a. The sinking fund

table shows that 0.317208 at 5% p.a. will in 3 years accumulate 1. Show the journal

entries and necessary accounts.

LOVELY PROFESSIONAL UNIVERSITY 249