Page 260 - DMGT104_FINANCIAL_ACCOUNTING

P. 260

Financial Accounting

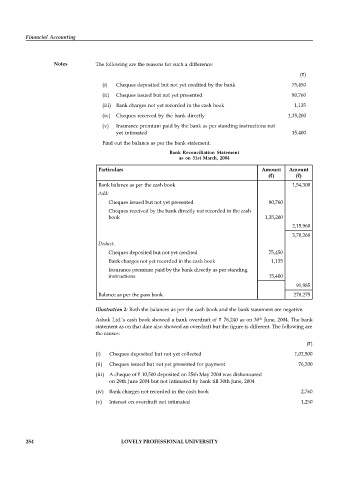

Notes The following are the reasons for such a difference:

( )

(i) Cheques deposited but not yet credited by the bank 75,450

(ii) Cheques issued but not yet presented 80,760

(iii) Bank charges not yet recorded in the cash book 1,135

(iv) Cheques received by the bank directly 1,35,200

(v) Insurance premium paid by the bank as per standing instructions not

yet intimated 15,400

Find out the balance as per the bank statement.

Bank Reconciliation Statement

as on 31st March, 2004

Particulars Amount Amount

( ) ( )

Bank balance as per the cash book 1,54,300

Add:

Cheques issued but not yet presented 80,760

Cheques received by the bank directly not recorded in the cash

book 1,35,200

2,15,960

3,70,260

Deduct.

Cheques deposited but not yet credited 75,450

Bank charges not yet recorded in the cash book 1,135

Insurance premium paid by the bank directly as per standing

instructions 15,400

91,985

Balance as per the pass book 278,275

Illustration 2: Both the balances as per the cash book and the bank statement are negative.

Ashok Ltd.’s cash book showed a bank overdraft of 76,240 as on 30 June, 2004. The bank

th

statement as on that date also showed an overdraft but the figure is different. The following are

the causes:

( )

(i) Cheques deposited but not yet collected 1,02,500

(ii) Cheques issued but not yet presented for payment 76,200

(iii) A cheque of 10,500 deposited on 25th May 2004 was dishonoured

on 29th June 2004 but not intimated by bank till 30th June, 2004

(iv) Bank charges not recorded in the cash book 2,760

(v) Interest on overdraft not intimated 1,250

254 LOVELY PROFESSIONAL UNIVERSITY