Page 263 - DMGT104_FINANCIAL_ACCOUNTING

P. 263

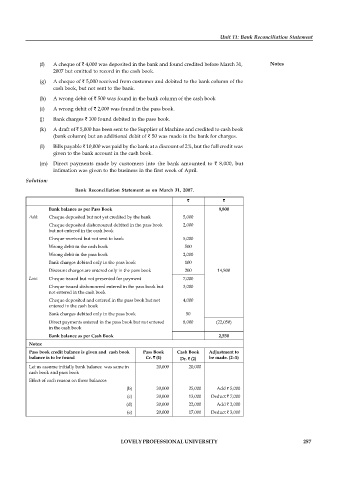

Unit 11: Bank Reconciliation Statement

(f) A cheque of 4,000 was deposited in the bank and found credited before March 31, Notes

2007 but omitted to record in the cash book.

(g) A cheque of 5,000 received from customer and debited to the bank column of the

cash book, but not sent to the bank.

(h) A wrong debit of 500 was found in the bank column of the cash book

(i) A wrong debit of 2,000 was found in the pass book.

(j) Bank charges 100 found debited in the pass book.

(k) A draft of 5,000 has been sent to the Supplier of Machine and credited to cash book

(bank column) but an additional debit of 50 was made in the bank for charges.

(l) Bills payable 10,000 was paid by the bank at a discount of 2%, but the full credit was

given to the bank account in the cash book.

(m) Direct payments made by customers into the bank amounted to 8,000, but

intimation was given to the business in the first week of April.

Solution:

Bank Reconciliation Statement as on March 31, 2007.

Bank balance as per Pass Book 9,800

Add: Cheque deposited but not yet credited by the bank 5,000

Cheque deposited dishonoured debited in the pass book 2,000

but not entered in the cash book

Cheque received but not sent to bank 5,000

Wrong debit in the cash book 500

Wrong debit in the pass book 2,000

Bank charges debited only in the pass book 100

Discount charges are entered only in the pass book 200 14,800

Less: Cheque issued but not presented for payment 7,000

Cheque issued dishonoured entered in the pass book but 3,000

not entered in the cash book

Cheque deposited and entered in the pass book but not 4,000

entered in the cash book

Bank charges debited only in the pass book 50

Direct payments entered in the pass book but not entered 8,000 (22,050)

in the cash book

Bank balance as per Cash Book 2,550

Notes:

Pass book credit balance is given and cash book Pass Book Cash Book Adjustment to

balance is to be found Cr. (1) Dr. (2) be made. (2–1)

Let us assume initially bank balance was same in 20,000 20,000

cash book and pass book

Effect of each reason on these balances

(b) 20,000 25,000 Add 5,000

(c) 20,000 13,000 Deduct 7,000

(d) 20,000 22,000 Add 2,000

(e) 20,000 17,000 Deduct 3,000

LOVELY PROFESSIONAL UNIVERSITY 257