Page 261 - DMGT104_FINANCIAL_ACCOUNTING

P. 261

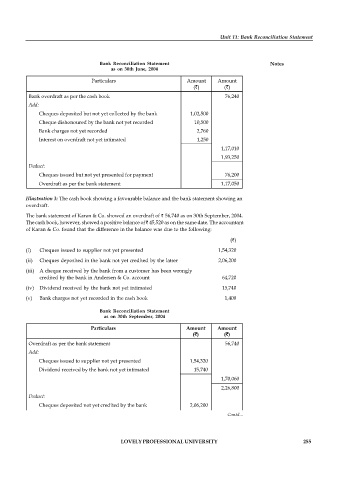

Unit 11: Bank Reconciliation Statement

Bank Reconciliation Statement Notes

as on 30th June, 2004

Particulars Amount Amount

( ) ( )

Bank overdraft as per the cash book 76,240

Add:

Cheques deposited but not yet collected by the bank 1,02,500

Cheque dishonoured by the bank not yet recorded 10,500

Bank charges not yet recorded 2,760

Interest on overdraft not yet intimated 1,250

1,17,010

1,93,250

Deduct:

Cheques issued but not yet presented for payment 76,200

Overdraft as per the bank statement 1,17,050

Illustration 3: The cash book showing a favourable balance and the bank statement showing an

overdraft.

The bank statement of Karan & Co. showed an overdraft of 56,740 as on 30th September, 2004.

The cash book, however, showed a positive balance of 45,520 as on the same date. The accountant

of Karan & Co. found that the difference in the balance was due to the following:

( )

(i) Cheques issued to supplier not yet presented 1,54,320

(ii) Cheques deposited in the bank not yet credited by the latter 2,06,200

(iii) A cheque received by the bank from a customer has been wrongly

credited by the bank in Andersen & Co. account 64,720

(iv) Dividend received by the bank not yet intimated 15,740

(v) Bank charges not yet recorded in the cash book 1,400

Bank Reconciliation Statement

as on 30th September, 2004

Particulars Amount Amount

( ) ( )

Overdraft as per the bank statement 56,740

Add:

Cheques issued to supplier not yet presented 1,54,320

Dividend received by the bank not yet intimated 15,740

1,70,060

2,26,800

Deduct:

Cheques deposited not yet credited by the bank 2,06,200

Cheque received from a customer wrongly credited by the Contd...

bank in Andersen & Co. A/c 64,720

Bank charges not yet recorded 1,400

2,72,320

LOVELY PROFESSIONAL UNIVERSITY 255

Bank balance (debit) as per the cash book 45,520