Page 264 - DMGT104_FINANCIAL_ACCOUNTING

P. 264

Financial Accounting

Notes

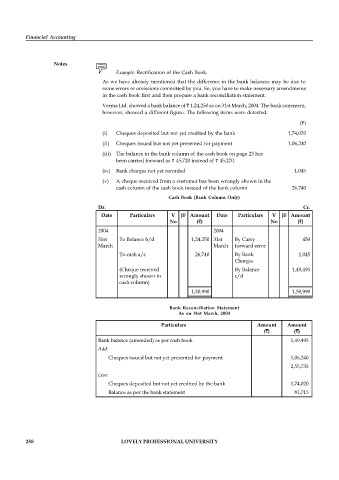

Example: Rectification of the Cash Book.

As we have already mentioned that the difference in the bank balances may be due to

some errors or omissions committed by you. So, you have to make necessary amendments

in the cash book first and then prepare a bank reconciliation statement.

Verma Ltd. showed a bank balance of 1,24,250 as on 31st March, 2004. The bank statement,

however, showed a different figure. The following items were detected:

( )

(i) Cheques deposited but not yet credited by the bank 1,74,020

(ii) Cheques issued but not yet presented for payment 1,06,240

(iii) The balance in the bank column of the cash book on page 23 has

been carried forward as 45,720 instead of 45,270.

(iv) Bank charges not yet recorded 1,045

(v) A cheque received from a customer has been wrongly shown in the

cash column of the cash book instead of the bank column 26,740

Cash Book (Bank Column Only)

Dr. Cr.

Date Particulars V JF Amount Date Particulars V JF Amount

No ( ) No ( )

2004 2004

31st To Balance b/d 1,24,250 31st By Carry 450

March March forward error

To cash a/c 26,740 By Bank 1,045

Charges

(Cheque received By Balance 1,49,495

wrongly shown in c/d

cash column)

1,50,990 1,50,990

Bank Reconciliation Statement

As on 31st March, 2004

Particulars Amount Amount

( ) ( )

Bank balance (amended) as per cash book 1,49,495

Add:

Cheques issued but not yet presented for payment 1,06,240

2,55,735

Less:

Cheques deposited but not yet credited by the bank 1,74,020

Balance as per the bank statement 81,715

258 LOVELY PROFESSIONAL UNIVERSITY