Page 71 - DMGT104_FINANCIAL_ACCOUNTING

P. 71

Unit 5: Preparation of Journal, Ledger and Balancing

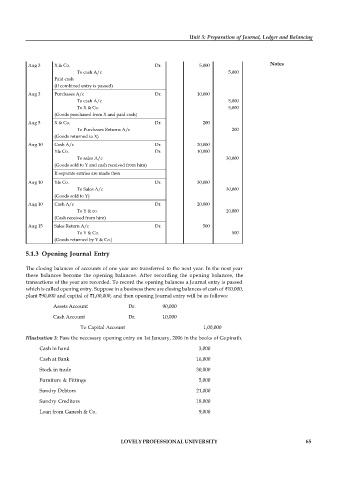

Aug 3 X & Co. Dr. 5,000 Notes

To cash A/c 5,000

Paid cash

(If combined entry is passed)

Aug 3 Purchases A/c Dr. 10,000

To cash A/c 5,000

To X & Co. 5,000

(Goods purchased from X and paid cash)

Aug 5 X & Co. Dr. 200

To Purchases Returns A/c 200

(Goods returned to X)

Aug 10 Cash A/c Dr. 20,000

Y& Co. Dr. 10,000

To sales A/c 30,000

(Goods sold to Y and cash received from him)

If separate entries are made then

Aug 10 Y& Co. Dr. 30,000

To Sales A/c 30,000

(Goods sold to Y)

Aug 10 Cash A/c Dr. 20,000

To Y & co. 20,000

(Cash received from him)

Aug 15 Sales Return A/c Dr. 500

To Y & Co. 500

(Goods returned by Y & Co.)

5.1.3 Opening Journal Entry

The closing balances of accounts of one year are transferred to the next year. In the next year

these balances become the opening balances. After recording the opening balances, the

transactions of the year are recorded. To record the opening balances a Journal entry is passed

which is called opening entry. Suppose in a business there are closing balances of cash of 10,000,

plant 90,000 and capital of 1,00,000, and then opening Journal entry will be as follows:

Assets Account Dr. 90,000

Cash Account Dr. 10,000

To Capital Account 1,00,000

Illustration 3: Pass the necessary opening entry on 1st January, 2006 in the books of Gopinath.

Cash in hand 3,000

Cash at Bank 16,000

Stock in trade 30,000

Furniture & Fittings 5,000

Sundry Debtors 21,000

Sundry Creditors 18,000

Loan from Ganesh & Co. 9,000

LOVELY PROFESSIONAL UNIVERSITY 65