Page 84 - DMGT104_FINANCIAL_ACCOUNTING

P. 84

Financial Accounting

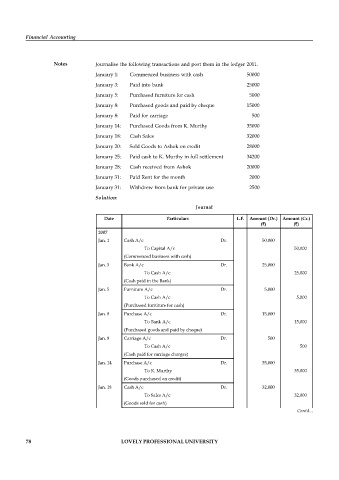

Notes Journalise the following transactions and post them in the ledger 2011.

January 1: Commenced business with cash 50000

January 3: Paid into bank 25000

January 5: Purchased furniture for cash 5000

January 8: Purchased goods and paid by cheque 15000

January 8: Paid for carriage 500

January 14: Purchased Goods from K. Murthy 35000

January 18: Cash Sales 32000

January 20: Sold Goods to Ashok on credit 28000

January 25: Paid cash to K. Murthy in full settlement 34200

January 28: Cash received from Ashok 20000

January 31: Paid Rent for the month 2000

January 31: Withdrew from bank for private use 2500

Solution:

Journal

Date Particulars L.F. Amount (Dr.) Amount (Cr.)

( ) ( )

2007

Jan. 1 Cash A/c Dr. 50,000

To Capital A/c 50,000

(Commenced business with cash)

Jan. 3 Bank A/c Dr. 25,000

To Cash A/c 25,000

(Cash paid in the Bank)

Jan. 5 Furniture A/c Dr. 5,000

To Cash A/c 5,000

(Purchased furniture for cash)

Jan. 8 Purchase A/c Dr. 15,000

To Bank A/c 15,000

(Purchased goods and paid by cheque)

Jan. 8 Carriage A/c Dr. 500

To Cash A/c 500

(Cash paid for carriage charges)

Jan. 14 Purchase A/c Dr. 35,000

To K. Murthy 35,000

(Goods purchased on credit)

Jan. 18 Cash A/c Dr. 32,000

To Sales A/c 32,000

(Goods sold for cash)

Jan. 20 Ashok Dr. 28,000 Contd...

To Sales A/c 28,000

(Goods sold to Ashok credit)

Jan. 25 K Murthy Dr. 35,000

78 LOVELY PROFESSIONAL UNIVERSITY

To Cash A/c 34,200

To Discount A/c 800

(Cash paid to K. Murthy a discount allowed by

them)

Jan. 28 Cash A/c Dr. 20,000

To Ashok 20,000

(Cash received from Ashok on Account)

Jan. 31 Rent A/c Dr. 2,000

To Cash A/c 2,000

(Cash paid for rent)

Jan. 31 Drawings A/c Dr. 2,500

To Bank A/c 2,500

(Cash withdrawn from bank for domestic use)