Page 114 - DECO201_MACRO_ECONOMICS_ENGLISH

P. 114

Unit 6: Investment

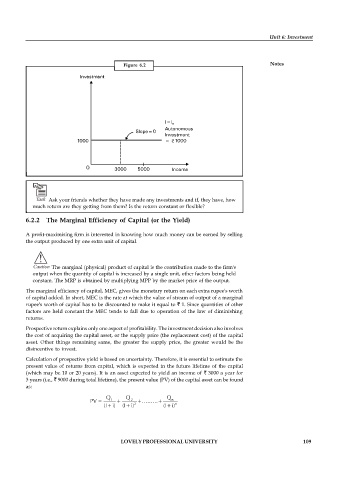

Figure 6.2 Notes

Task Ask your friends whether they have made any investments and if, they have, how

much return are they getting from them? Is the return constant or flexible?

6.2.2 The Marginal Efficiency of Capital (or the Yield)

A profit-maximising firm is interested in knowing how much money can be earned by selling

the output produced by one extra unit of capital.

!

Caution The marginal (physical) product of capital is the contribution made to the firm's

output when the quantity of capital is increased by a single unit, other factors being held

constant. The MRP is obtained by multiplying MPP by the market price of the output.

The marginal efficiency of capital, MEC, gives the monetary return on each extra rupee's worth

of capital added. In short, MEC is the rate at which the value of stream of output of a marginal

rupee's worth of capital has to be discounted to make it equal to 1. Since quantities of other

factors are held constant the MEC tends to fall due to operation of the law of diminishing

returns.

Prospective return explains only one aspect of profitability. The investment decision also involves

the cost of acquiring the capital asset, or the supply price (the replacement cost) of the capital

asset. Other things remaining same, the greater the supply price, the greater would be the

disincentive to invest.

Calculation of prospective yield is based on uncertainty. Therefore, it is essential to estimate the

present value of returns from capital, which is expected in the future lifetime of the capital

(which may be 10 or 20 years). It is an asset expected to yield an income of 3000 a year for

3 years (i.e., 9000 during total lifetime), the present value (PV) of the capital asset can be found

as:

LOVELY PROFESSIONAL UNIVERSITY 109