Page 209 - DMGT202_COST_AND_MANAGEMENT_ACCOUNTING

P. 209

Cost and Management Accounting

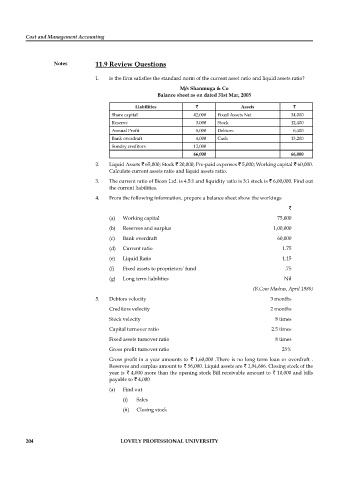

Notes 11.9 Review Questions

1. Is the fi rm satisfies the standard norm of the current asset ratio and liquid assets ratio?

M/s Shanmuga & Co

Balance sheet as on dated 31st Mar, 2005

Liabilities ` Assets `

Share capital 42,000 Fixed Assets Net 34,000

Reserve 3,000 Stock 12,400

Annual Profi t 5,000 Debtors 6,400

Bank overdraft 4,000 Cash 13,200

Sundry creditors 12,000

66,000 66,000

2. Liquid Assets ` 65,000; Stock ` 20,000; Pre-paid expenses ` 5,000; Working capital ` 60,000.

Calculate current assets ratio and liquid assets ratio.

3. The current ratio of Bicon Ltd. is 4.5:1 and liquidity ratio is 3:1 stock is ` 6,00,000. Find out

the current liabilities.

4. From the following information, prepare a balance sheet show the workings

`

(a) Working capital 75,000

(b) Reserves and surplus 1,00,000

(c) Bank overdraft 60,000

(d) Current ratio 1.75

(e) Liquid Ratio 1.15

(f) Fixed assets to proprietors’ fund .75

(g) Long term liabilities Nil

(B.Com Madras, April 1980)

5. Debtors velocity 3 months

Creditors velocity 2 months

Stock velocity 8 times

Capital turnover ratio 2.5 times

Fixed assets turnover ratio 8 times

Gross profit turnover ratio 25%

Gross profit in a year amounts to ` 1,60,000 .There is no long term loan or overdraft .

Reserves and surplus amount to ` 56,000. Liquid assets are ` 1,94,666. Closing stock of the

year is ` 4,000 more than the opening stock Bill receivable amount to ` 10,000 and bills

payable to ` 4,000

(a) Find out

(i) Sales

(ii) Closing stock

204 LOVELY PROFESSIONAL UNIVERSITY