Page 85 - DMGT202_COST_AND_MANAGEMENT_ACCOUNTING

P. 85

Cost and Management Accounting

Notes

!

Caution The adjustment of under absorbed overhead would result in a loss in the form

of increase in cost where the under absorption is normal and in the form of abnormal loss

where it is abnormal.

5.3.2 Over Absorption of Overhead

The overheads are over absorbed if the actual overheads incurred are less than the overheads

absorbed.

Over-absorbed overhead = Absorbed overhead – Incurred overhead

Example:

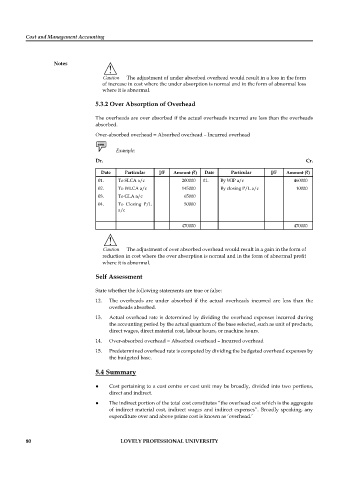

Dr. Cr.

Date Particular J/F Amount (`) Date Particular J/F Amount (`)

01. To SLCA a/c 200000 01. By WIP a/c 460000

02. To WLCA a/c 145000 By closing P/L a/c 10000

03. To GLA a/c 65000

04. To Closing P/L 50000

a/c

470000 470000

!

Caution The adjustment of over absorbed overhead would result in a gain in the form of

reduction in cost where the over absorption is normal and in the form of abnormal profi t

where it is abnormal.

Self Assessment

State whether the following statements are true or false:

12. The overheads are under absorbed if the actual overheads incurred are less than the

overheads absorbed.

13. Actual overhead rate is determined by dividing the overhead expenses incurred during

the accounting period by the actual quantum of the base selected, such as unit of products,

direct wages, direct material cost, labour hours, or machine hours.

14. Over-absorbed overhead = Absorbed overhead – Incurred overhead

15. Predetermined overhead rate is computed by dividing the budgeted overhead expenses by

the budgeted base.

5.4 Summary

Cost pertaining to a cost centre or cost unit may be broadly, divided into two portions,

direct and indirect.

The indirect portion of the total cost constitutes “the overhead cost which is the aggregate

of indirect material cost, indirect wages and indirect expenses”. Broadly speaking, any

expenditure over and above prime cost is known as ‘overhead.’

80 LOVELY PROFESSIONAL UNIVERSITY