Page 83 - DMGT202_COST_AND_MANAGEMENT_ACCOUNTING

P. 83

Cost and Management Accounting

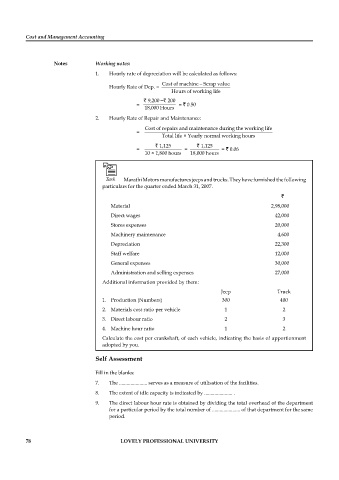

Notes Working notes:

1. Hourly rate of depreciation will be calculated as follows:

−

Cost of machine Scrap value

Hourly Rate of Dep. =

Hours of working life

` 9,200 −` 200

= = ` 0.50

18,000 Hours

2. Hourly Rate of Repair and Maintenance:

Cost of repairs and maintenance during the working life

=

Total life × Yearly normal working hours

` 1,125 ` 1,125

= = = ` 0.06

10 × 1,800 hours 18,000 hours

Task Marathi Motors manufactures jeeps and trucks. They have furnished the following

particulars for the quarter ended March 31, 2007.

`

Material 2,98,000

Direct wages 42,000

Stores expenses 20,000

Machinery maintenance 4,600

Depreciation 22,300

Staff welfare 12,000

General expenses 30,000

Administration and selling expenses 27,000

Additional information provided by them:

Jeep Truck

1. Production (Numbers) 300 400

2. Materials cost ratio per vehicle 1 2

3. Direct labour ratio 2 3

4. Machine hour ratio 1 2

Calculate the cost per crankshaft, of each vehicle, indicating the basis of apportionment

adopted by you.

Self Assessment

Fill in the blanks:

7. The ...................... serves as a measure of utilisation of the facilities.

8. The extent of idle capacity is indicated by ...................... .

9. The direct labour hour rate is obtained by dividing the total overhead of the department

for a particular period by the total number of ...................... of that department for the same

period.

78 LOVELY PROFESSIONAL UNIVERSITY