Page 78 - DMGT202_COST_AND_MANAGEMENT_ACCOUNTING

P. 78

Unit 5: Overheads

2. Convenience: The overhead rate should be simple to calculate and easy to understand. Notes

It should be convenient in application. It should not require unnecessary or additional

clerical work.

3. Time Factor: Overhead rate should have some relation to the time taken by various

jobs for completion. Thus, if a job takes twice as much another job, the first job should

be charged twice the amount charged to the second job. It is because of this reason

that direct wages percentage rate is preferred over direct material cost percentage

rate.

4. Manual or Machine Work: The work done by manual labour is to be distinguished

from work done by machines and different overhead rates should be applied for

manual and machine work.

5. Different Overhead Rates: Different overhead rates should be ascertained for

different departments where the nature of work done by one department is different

from the work done by other department or departments.

6. Information: The selection of most appropriate overhead rate depends on the extent

of information available or recorded.

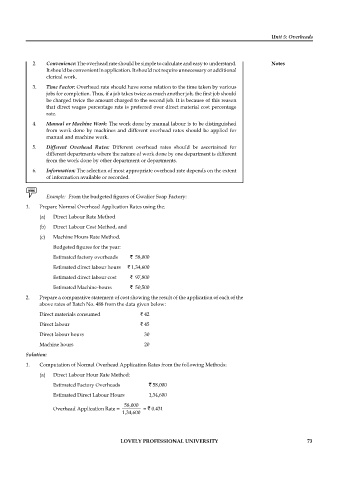

Example: From the budgeted figures of Gwalior Soap Factory:

1. Prepare Normal Overhead Application Rates using the:

(a) Direct Labour Rate Method

(b) Direct Labour Cost Method, and

(c) Machine Hours Rate Method.

Budgeted figures for the year:

Estimated factory overheads ` 58,000

Estimated direct labour hours ` 1,34,600

Estimated direct labour cost ` 97,800

Estimated Machine-hours ` 50,500

2. Prepare a comparative statement of cost showing the result of the application of each of the

above rates of Batch No. 488 from the data given below:

Direct materials consumed ` 42

Direct labour ` 45

Direct labour hours 30

Machine hours 20

Solution:

1. Computation of Normal Overhead Application Rates from the following Methods:

(a) Direct Labour Hour Rate Method:

Estimated Factory Overheads ` 58,000

Estimated Direct Labour Hours 1,34,600

58,000

Overhead Application Rate = = ` 0.431

1,34,600

LOVELY PROFESSIONAL UNIVERSITY 73