Page 200 - DMGT207_MANAGEMENT_OF_FINANCES

P. 200

Unit 8: Capital Structure Decision

Shareholder-bondholder Conflicts Notes

Shareholder value is created either by increasing the value of the firm or by reducing the value

of its bonds. Increasing the risk of the firm or issuing substantial new debt are ways to redistribute

wealth from bondholders to shareholders. Shareholders do not like excessive debt.

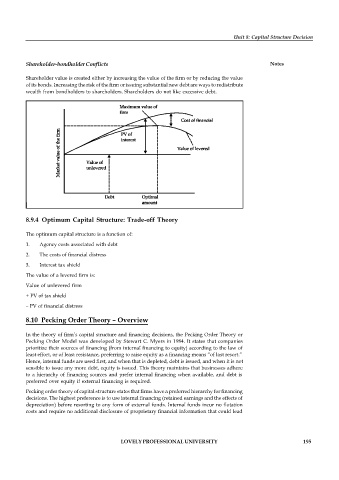

8.9.4 Optimum Capital Structure: Trade-off Theory

The optimum capital structure is a function of:

1. Agency costs associated with debt

2. The costs of financial distress

3. Interest tax shield

The value of a levered firm is:

Value of unlevered firm

+ PV of tax shield

– PV of financial distress

8.10 Pecking Order Theory – Overview

In the theory of firm’s capital structure and financing decisions, the Pecking Order Theory or

Pecking Order Model was developed by Stewart C. Myers in 1984. It states that companies

prioritize their sources of financing (from internal financing to equity) according to the law of

least effort, or of least resistance, preferring to raise equity as a financing means “of last resort.”

Hence, internal funds are used first, and when that is depleted, debt is issued, and when it is not

sensible to issue any more debt, equity is issued. This theory maintains that businesses adhere

to a hierarchy of financing sources and prefer internal financing when available, and debt is

preferred over equity if external financing is required.

Pecking order theory of capital structure states that firms have a preferred hierarchy for financing

decisions. The highest preference is to use internal financing (retained earnings and the effects of

depreciation) before resorting to any form of external funds. Internal funds incur no flotation

costs and require no additional disclosure of proprietary financial information that could lead

LOVELY PROFESSIONAL UNIVERSITY 195