Page 197 - DMGT207_MANAGEMENT_OF_FINANCES

P. 197

Management of Finances

Notes Understanding the tax benefit associated with firm L’s debt is important. While firm L must pay

its bond holders 200 as interest payment it will pay 80 less in taxes. The interest payment

shielded some of firm L’s taxable income from tax.

Self Assessment

State whether the following statements are true or false:

11. Net income approach of capital structure was propounded by David Durand.

12. According to NI approach the cost of debt and the cost of equity change with a change in

the leverage ratio.

13. According to NI theory, cost of equity is assumed to be less than the cost of debt.

14. Net Operating Income (NOI) theory is propounded by David Durand.

15. According to NOI theory, the market value of the firm is not affected by the capital

structure changes.

16. The WACC approach is midway between the NI and NOI approach.

17. According to WACC approach, the cost of debt remains almost constant up to certain

degree of leverage but decreases thereafter at an increasing rate.

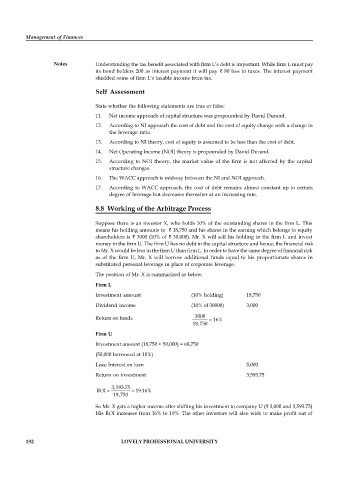

8.8 Working of the Arbitrage Process

Suppose there is an investor X, who holds 10% of the outstanding shares in the firm L. This

means his holding amounts to 18,750 and his shares in the earning which belongs to equity

shareholders is 3000 (10% of 30,000). Mr. X will sell his holding in the firm L and invest

money in the firm U. The firm U has no debt in the capital structure and hence, the financial risk

to Mr. X would be less in the firm U than firm L. In order to have the same degree of financial risk

as of the firm U, Mr. X will borrow additional funds equal to his proportionate shares in

substituted personal leverage in place of corporate leverage.

The position of Mr. X is summarized as below.

Firm L

Investment amount (10% holding) 18,750

Dividend income (10% of 30000) 3,000

Return on funds 3000 = 16%

18,750

Firm U

Investment amount (18,750 + 50,000) = 68,750

(50,000 borrowed at 10%)

Less: Interest on loan 5,000

Return on investment 3,593.75

ROI = 3,593.75 = 19.16%

18,750

So Mr. X gets a higher income after shifting his investment to company U ( 3,000 and 3,593.75)

His ROI increases from 16% to 19%. The other investors will also wish to make profit out of

192 LOVELY PROFESSIONAL UNIVERSITY