Page 257 - DMGT207_MANAGEMENT_OF_FINANCES

P. 257

Management of Finances

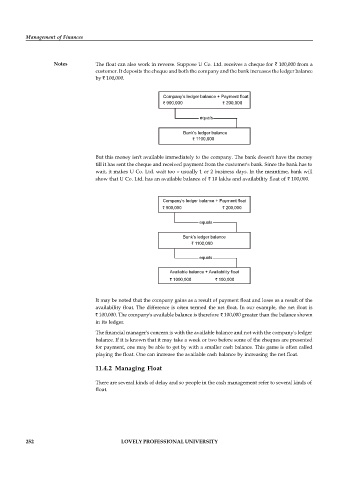

Notes The float can also work in reverse. Suppose U Co. Ltd. receives a cheque for 100,000 from a

customer. It deposits the cheque and both the company and the bank increases the ledger balance

by 100,000.

Company’s ledger balance + Payment float

900,000 200,000

equals

Bank’s ledger balance

1100,000

But this money isn't available immediately to the company. The bank doesn't have the money

till it has sent the cheque and received payment from the customer's bank. Since the bank has to

wait, it makes U Co. Ltd. wait too – usually 1 or 2 business days. In the meantime, bank will

show that U Co. Ltd. has an available balance of 10 lakhs and availability float of 100,000.

Company’s ledger balance + Payment float

900,000 200,000

equals

Bank’s ledger balance

1100,000

equals

Available balance + Availability float

1000,000 100,000

It may be noted that the company gains as a result of payment float and loses as a result of the

availability float. The difference is often termed the net float. In our example, the net float is

100,000. The company's available balance is therefore 100,000 greater than the balance shown

in its ledger.

The financial manager's concern is with the available balance and not with the company's ledger

balance. If it is known that it may take a week or two before some of the cheques are presented

for payment, one may be able to get by with a smaller cash balance. This game is often called

playing the float. One can increase the available cash balance by increasing the net float.

11.4.2 Managing Float

There are several kinds of delay and so people in the cash management refer to several kinds of

float.

252 LOVELY PROFESSIONAL UNIVERSITY