Page 258 - DMGT207_MANAGEMENT_OF_FINANCES

P. 258

Unit 11: Management of Cash

Notes

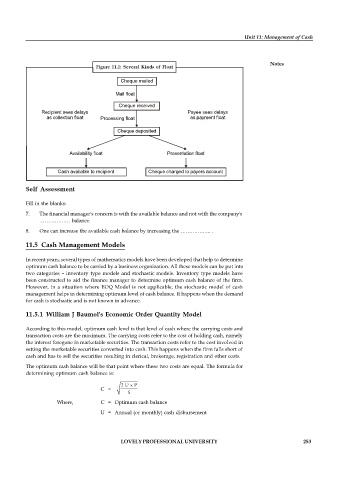

Figure 11.1: Several Kinds of Float

Cheque mailed

Mail float

Cheque received

Recipient sees delays Payee sees delays

as collection float Processing float as payment float

Cheque deposited

Availability float Presentation float

Cash available to recipient Cheque charged to payers account

Self Assessment

Fill in the blanks:

7. The financial manager's concern is with the available balance and not with the company's

……………… balance.

8. One can increase the available cash balance by increasing the ……………... .

11.5 Cash Management Models

In recent years, several types of mathematics models have been developed that help to determine

optimum cash balance to be carried by a business organization. All these models can be put into

two categories – inventory type models and stochastic models. Inventory type models have

been constructed to aid the finance manager to determine optimum cash balance of the firm.

However, in a situation where EOQ Model is not applicable, the stochastic model of cash

management helps in determining optimum level of cash balance. It happens when the demand

for cash is stochastic and is not known in advance.

11.5.1 William J Baumol's Economic Order Quantity Model

According to this model, optimum cash level is that level of cash where the carrying costs and

transaction costs are the maximum. The carrying costs refer to the cost of holding cash, namely

the interest foregone in marketable securities. The transaction costs refer to the cost involved in

setting the marketable securities converted into cash. This happens when the firm falls short of

cash and has to sell the securities resulting in clerical, brokerage, registration and other costs.

The optimum cash balance will be that point where these two costs are equal. The formula for

determining optimum cash balance is:

C =

Where, C = Optimum cash balance

U = Annual (or monthly) cash disbursement

LOVELY PROFESSIONAL UNIVERSITY 253