Page 206 - DMGT303_BANKING_AND_INSURANCE

P. 206

Unit 10: Non-performing Assets

Deregulation, technological upgradation and increased market integration have been the key Notes

factors driving change in our financial sector.

After the reforms, the Indian banking system has become increasingly mature in terms of the

transformation of business processes and the appetite for risk management.

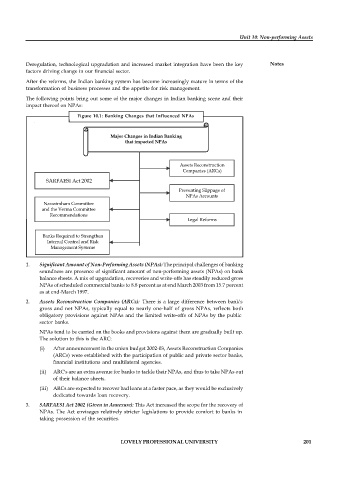

The following points bring out some of the major changes in Indian banking scene and their

impact thereof on NPAs:

Figure 10.1: Banking Changes that Influenced NPAs

Major Changes in Indian Banking

that impacted NPAs

Assets Reconstruction

Companies (ARCs)

SARFAESI Act 2002

Preventing Slippage of

NPAs Accounts

Narasimham Committee

and the Verma Committee

Recommendations

Legal Reforms

Banks Required to Strengthen

Internal Control and Risk

Management Systems

1. Significant Amount of Non-Performing Assets (NPAs): The principal challenges of banking

soundness are presence of significant amount of non-performing assets (NPAs) on bank

balance sheets. A mix of upgradation, recoveries and write-offs has steadily reduced gross

NPAs of scheduled commercial banks to 8.8 percent as at end March 2003 from 15.7 percent

as at end-March 1997.

2. Assets Reconstruction Companies (ARCs): There is a large difference between bank's

gross and net NPAs, typically equal to nearly one-half of gross NPAs, reflects both

obligatory provisions against NPAs and the limited write-offs of NPAs by the public

sector banks.

NPAs tend to be carried on the books and provisions against them are gradually built up.

The solution to this is the ARC:

(i) After announcement in the union budget 2002-03, Assets Reconstruction Companies

(ARCs) were established with the participation of public and private sector banks,

financial institutions and multilateral agencies.

(ii) ARC's are an extra avenue for banks to tackle their NPAs, and thus to take NPAs out

of their balance sheets.

(iii) ARCs are expected to recover bad loans at a faster pace, as they would be exclusively

dedicated towards loan recovery.

3. SARFAESI Act 2002 (Given in Annexure): This Act increased the scope for the recovery of

NPAs. The Act envisages relatively stricter legislations to provide comfort to banks in

taking possession of the securities.

LOVELY PROFESSIONAL UNIVERSITY 201