Page 23 - DMGT303_BANKING_AND_INSURANCE

P. 23

Banking and Insurance

Notes

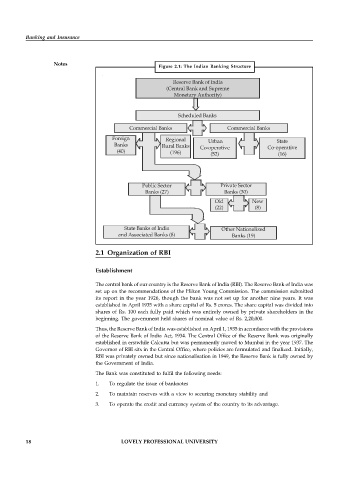

Figure 2.1: The Indian Banking Structure

Reserve Bank of India

(Central Bank and Supreme

Monetary Authority)

Scheduled Banks

Commercial Banks Commercial Banks

Foreign Regional Urban State

Banks Rural Banks Co-operative Co-operative

(40) (196) (52) (16)

Public Sector Private Sector

Banks (27) Banks (30)

Old New

(22) (8)

State Banks of India Other Nationalized

and Associated Banks (8) Banks (19)

2.1 Organization of RBI

Establishment

The central bank of our country is the Reserve Bank of India (RBI). The Reserve Bank of India was

set up on the recommendations of the Hilton Young Commission. The commission submitted

its report in the year 1926, though the bank was not set up for another nine years. It was

established in April 1935 with a share capital of Rs. 5 crores. The share capital was divided into

shares of Rs. 100 each fully paid which was entirely owned by private shareholders in the

beginning. The government held shares of nominal value of Rs. 2,20,000.

Thus, the Reserve Bank of India was established on April 1, 1935 in accordance with the provisions

of the Reserve Bank of India Act, 1934. The Central Office of the Reserve Bank was originally

established in erstwhile Calcutta but was permanently moved to Mumbai in the year 1937. The

Governor of RBI sits in the Central Office, where policies are formulated and finalized. Initially,

RBI was privately owned but since nationalisation in 1949, the Reserve Bank is fully owned by

the Government of India.

The Bank was constituted to fulfil the following needs:

1. To regulate the issue of banknotes

2. To maintain reserves with a view to securing monetary stability and

3. To operate the credit and currency system of the country to its advantage.

18 LOVELY PROFESSIONAL UNIVERSITY