Page 151 - DMGT306_MERCANTILE_LAWS_II

P. 151

Mercantile Laws – II

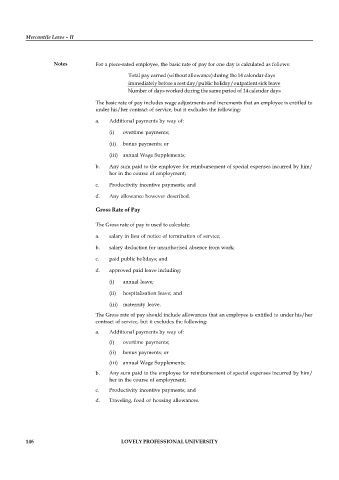

Notes For a piece-rated employee, the basic rate of pay for one day is calculated as follows:

Total pay earned (without allowance) during the 14 calendar days

immediately before a rest day/public holiday/outpatient sick leave

Number of days worked during the same period of 14 calendar days

The basic rate of pay includes wage adjustments and increments that an employee is entitled to

under his/her contract of service, but it excludes the following:

a. Additional payments by way of:

(i) overtime payments;

(ii) bonus payments; or

(iii) annual Wage Supplements;

b. Any sum paid to the employee for reimbursement of special expenses incurred by him/

her in the course of employment;

c. Productivity incentive payments; and

d. Any allowance however described.

Gross Rate of Pay

The Gross rate of pay is used to calculate:

a. salary in lieu of notice of termination of service;

b. salary deduction for unauthorised absence from work;

c. paid public holidays; and

d. approved paid leave including:

(i) annual leave;

(ii) hospitalisation leave; and

(iii) maternity leave.

The Gross rate of pay should include allowances that an employee is entitled to under his/her

contract of service, but it excludes the following:

a. Additional payments by way of:

(i) overtime payments;

(ii) bonus payments; or

(iii) annual Wage Supplements;

b. Any sum paid to the employee for reimbursement of special expenses incurred by him/

her in the course of employment;

c. Productivity incentive payments; and

d. Traveling, food or housing allowances.

146 LOVELY PROFESSIONAL UNIVERSITY