Page 124 - DMGT403_ACCOUNTING_FOR_MANAGERS

P. 124

Unit 6: Financial Statements: Analysis and Interpretation

Notes

Example: A company has a closing stock of 30,000 while its prepaid expenses are

5000. What will be its quick assets ratio if the current assets are worth 50000 while current

liabilities are worth 15000?

Solution:

Liquid Asset = Current Assets – (Closing Stock + Prepaid Expenses)

= 50000 – (30000 + 5000)

= 15000

Liquid Assets

Quick Assets Ratio =

Current Liabilities

= 15000/15000 = 1:1

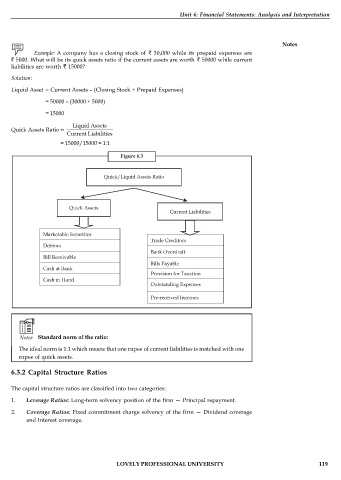

Figure 6.3

Notes Standard norm of the ratio:

The ideal norm is 1:1 which means that one rupee of current liabilities is matched with one

rupee of quick assets.

6.3.2 Capital Structure Ratios

The capital structure ratios are classified into two categories:

1. Leverage Ratios: Long-term solvency position of the firm — Principal repayment.

2. Coverage Ratios: Fixed commitment charge solvency of the firm — Dividend coverage

and Interest coverage.

LOVELY PROFESSIONAL UNIVERSITY 119