Page 288 - DMGT403_ACCOUNTING_FOR_MANAGERS

P. 288

Unit 13: Decision Involving Alternative Choices

If it is decided to work the factory at 50% capacity, the selling price falls by 3%. At 90% Notes

capacity the selling price falls by 5% accompanied by a similar fall in the prices of material.

You are required to calculate the profit at 50% and 90% capacities and also calculate break

even point for the same capacity productions.

5. Examine the various kinds of managerial decisions.

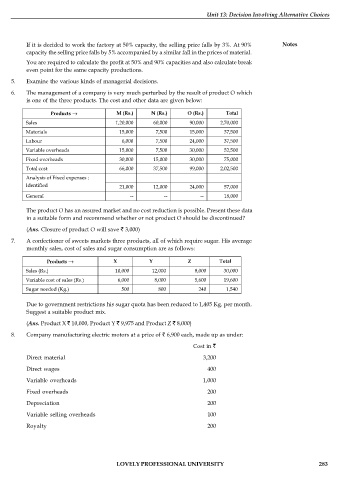

6. The management of a company is very much perturbed by the result of product O which

is one of the three products. The cost and other data are given below:

Products M (Rs.) N (Rs.) O (Rs.) Total

Sales 1,20,000 60,000 90,000 2,70,000

Materials 15,000 7,500 15,000 37,500

Labour 6,000 7,500 24,000 37,500

Variable overheads 15,000 7,500 30,000 52,500

Fixed overheads 30,000 15,000 30,000 75,000

Total cost 66,000 37,500 99,000 2,02,500

Analysis of Fixed expenses :

Identified 21,000 12,000 24,000 57,000

General -- -- -- 18,000

The product O has an assured market and no cost reduction is possible. Present these data

in a suitable form and recommend whether or not product O should be discontinued?

(Ans. Closure of product O will save 3,000)

7. A confectioner of sweets markets three products, all of which require sugar. His average

monthly sales, cost of sales and sugar consumption are as follows:

Products X Y Z Total

Sales (Rs.) 10,000 12,000 8,000 30,000

Variable cost of sales (Rs.) 6,000 8,000 5,600 19,600

Sugar needed (Kg.) 500 800 240 1,540

Due to government restrictions his sugar quota has been reduced to 1,405 Kg. per month.

Suggest a suitable product mix.

(Ans. Product X 10,000, Product Y 9,975 and Product Z 8,000)

8. Company manufacturing electric motors at a price of 6,900 each, made up as under:

Cost in

Direct material 3,200

Direct wages 400

Variable overheads 1,000

Fixed overheads 200

Depreciation 200

Variable selling overheads 100

Royalty 200

LOVELY PROFESSIONAL UNIVERSITY 283