Page 38 - DMGT403_ACCOUNTING_FOR_MANAGERS

P. 38

Unit 2: Recording of Transactions

Notes

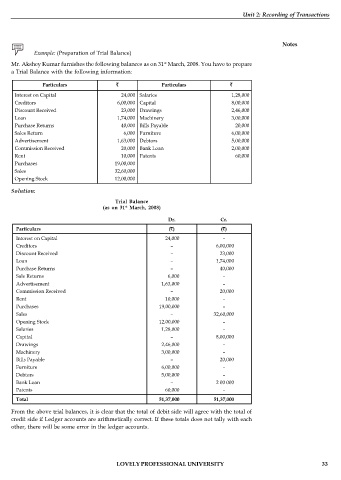

Example: (Preparation of Trial Balance)

st

Mr. Akshey Kumar furnishes the following balances as on 31 March, 2008. You have to prepare

a Trial Balance with the following information:

Particulars Particulars

Interest on Capital 24,000 Salaries 1,28,000

Creditors 6,00,000 Capital 8,00,000

Discount Received 23,000 Drawings 2,46,000

Loan 1,74,000 Machinery 3,00,000

Purchase Returns 40,000 Bills Payable 20,000

Sales Return 6,000 Furniture 6,00,000

Advertisement 1,63,000 Debtors 5,00,000

Commission Received 20,000 Bank Loan 2,00,000

Rent 10,000 Patents 60,000

Purchases 19,00,000

Sales 32,60,000

Opening Stock 12,00,000

Solution:

Trial Balance

st

(as on 31 March, 2008)

Dr. Cr.

Particulars ( ) ( )

Interest on Capital 24,000 –

Creditors – 6,00,000

Discount Received – 23,000

Loan – 1,74,000

Purchase Returns – 40,000

Sale Returns 6,000 –

Advertisement 1,63,000 –

Commission Received – 20,000

Rent 10,000 –

Purchases 19,00,000 –

Sales – 32,60,000

Opening Stock 12,00,000 –

Salaries 1,28,000 –

Capital – 8,00,000

Drawings 2,46,000 –

Machinery 3,00,000 –

Bills Payable – 20,000

Furniture 6,00,000 –

Debtors 5,00,000 –

Bank Loan – 2 00 000

Patents 60,000 –

Total 51,37,000 51,37,000

From the above trial balances, it is clear that the total of debit side will agree with the total of

credit side if Ledger accounts are arithmetically correct. If these totals does not tally with each

other, there will be some error in the ledger accounts.

LOVELY PROFESSIONAL UNIVERSITY 33