Page 44 - DMGT403_ACCOUNTING_FOR_MANAGERS

P. 44

Unit 2: Recording of Transactions

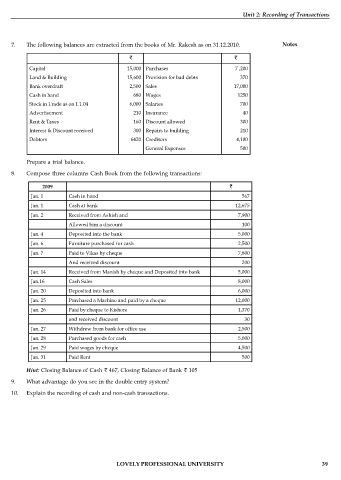

7. The following balances are extracted from the books of Mr. Rakesh as on 31.12.2010. Notes

Capital 15,000 Purchases 7 ,200

Land & Building 15,600 Provision for bad debts 370

Bank overdraft 2,500 Sales 17,000

Cash in hand 680 Wages 1250

Stock in Trade as on 1.1.04 6,000 Salaries 700

Advertisement 210 Insurance 40

Rent & Taxes 160 Discount allowed 300

Interest & Discount received 300 Repairs to building 210

Debtors 6420 Creditors 4,100

General Expenses 500

Prepare a trial balance.

8. Compose three columns Cash Book from the following transactions:

2009

Jan. 1 Cash in hand 567

Jan. 1 Cash at bank 12,675

Jan. 2 Received from Ashish and 7,900

Allowed him a discount 100

Jan. 4 Deposited into the bank 5,000

Jan. 6 Furniture purchased for cash 2,500

Jan. 7 Paid to Vikas by cheque 7,800

And received discount 200

Jan. 14 Received from Manish by cheque and Deposited into bank 5,000

Jan.16 Cash Sales 8,000

Jan. 20 Deposited into bank 6,000

Jan. 25 Purchased a Machine and paid by a cheque 12,000

Jan. 26 Paid by cheque to Kishore 1,370

and received discount 30

Jan. 27 Withdrew from bank for office use 2,500

Jan. 28 Purchased goods for cash 5,000

Jan. 29 Paid wages by cheque 4,500

Jan. 31 Paid Rent 500

Hint: Closing Balance of Cash 467, Closing Balance of Bank 105

9. What advantage do you see in the double entry system?

10. Explain the recording of cash and non-cash transactions.

LOVELY PROFESSIONAL UNIVERSITY 39