Page 196 - DMGT408DMGT203_Marketing Management

P. 196

Unit 8: Pricing: Understanding and Capturing Customer Value

Notes

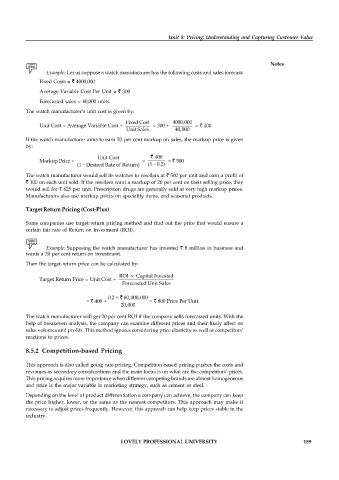

Example: Let us suppose a watch manufacturer has the following costs and sales forecast:

Fixed Costs = ` 4000,000

Average Variable Cost Per Unit = ` 300

Forecasted sales = 40,000 units.

The watch manufacturer’s unit cost is given by:

Fixed Cost 4000,000

Unit Cost = Average Variable Cost + = 300 + = ` 400

Unit Sales 40,000

If the watch manufacturer aims to earn 20 per cent markup on sales, the markup price is given

by:

Unit Cost ` 400

Markup Price = = = ` 500

(1 − Desired Rate of Return) (1 − 0.2)

The watch manufacturer would sell its watches to resellers at ` 500 per unit and earn a profit of

` 100 on each unit sold. If the resellers want a markup of 20 per cent on their selling price, they

would sell for ` 625 per unit. Prescription drugs are generally sold at very high markup prices.

Manufacturers also use markup prices on speciality items, and seasonal products.

Target Return Pricing (Cost-Plus)

Some companies use target-return pricing method and find out the price that would ensure a

certain fair rate of Return on Investment (ROI).

Example: Supposing the watch manufacturer has invested ` 8 million in business and

wants a 20 per cent return on investment.

Then the target-return price can be calculated by:

ROI × Capital Invested

Target Return Price = Unit Cost +

Forecasted Unit Sales

0.2 × ` 80,000,000

= ` 400 + = ` 800 Price Per Unit

20,000

The watch manufacturer will get 20 per cent ROI if the company sells forecasted units. With the

help of breakeven analysis, the company can examine different prices and their likely affect on

sales volumes and profits. This method ignores considering price elasticity as well as competitors’

reactions to prices.

8.5.2 Competition-based Pricing

This approach is also called going rate pricing. Competition-based pricing pushes the costs and

revenues as secondary considerations and the main focus is on what are the competitors’ prices.

This pricing acquires more importance when different competing brands are almost homogeneous

and price is the major variable in marketing strategy, such as cement or steel.

Depending on the level of product differentiation a company can achieve, the company can keep

the price higher, lower, or the same as the nearest competitors. This approach may make it

necessary to adjust prices frequently. However, this approach can help keep prices stable in the

industry.

LOVELY PROFESSIONAL UNIVERSITY 189