Page 125 - DMGT545_INTERNATIONAL_BUSINESS

P. 125

International Business

notes FDI takes on two main forms; the first is a green field investment, which involves the establishment

of a wholly new operation in a foreign country. The second involves acquiring or merging with

an existing firm in a foreign country. Acquisition can be a minority (where the foreign firm

takes a 10 percent to 49 percent interest in the company’s Share Capital and voting rights), or

majority (foreign interest of 10 percent to 99 percent) or full outright stake (foreign interest of 100

percent).

There is an important distinction between FDI and Foreign Portfolio Investment (FPI). Foreign

portfolio investment is investment by individuals, firms or public bodies (e.g. National and

local Govts) in foreign financial instruments, (e.g. Government bonds, foreign stocks). FDI does

not involve taking a significant equity stake in a foreign business entity. FPI is determined by

different facts than FDI. FPI provides great opportunities for business and individuals to build a

truly diversified portfolio of international investments in financial assets, which lowers risk.

Notes FDI takes on two main forms; the first is a green field investment, which

involves the establishment of a wholly new operation in a foreign country. The second

involves acquiring or merging with an existing firm in a foreign country.

7.1 overview of foreign Direct investment

FDI means investment in a foreign country where the investor retains control over the investment.

FDI implies that the investor exerts a significant degree of influence on the management of the

enterprise in other country. It normally takes the form of starting a subsidiary, acquiring a stake

in the existing firm or starting a joint venture in the foreign country.

Since FDIs cannot be easily liquidated, these are governed by long-term considerations. So the

FDI decisions are affected by the following factors:

1. Political stability,

2. Government policy,

3. State of economic development,

4. Industrial prospects, etc.

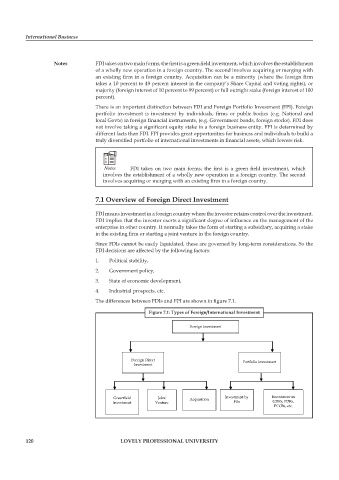

The differences between FDIs and FPI are shown in figure 7.1.

figure 7.1: types of foreign/international investment

Foreign Investment

Foreign Direct Portfolio Investment

Investment

Greenfield Joint Acquisition Investment by Investment in

Investment Venture FIIs GDRs, FDRs,

FCCBs, etc.

120 lovely Professional university