Page 293 - DMGT551_RETAIL_BUSINESS_ENVIRONMENT

P. 293

Retail Business Environment

Notes SKUs or goods) and stock outs (lack of automated ordering systems and real time inventory),

and very low inventory turns (loads of slow moving inventory in stock).

Viewing it as a sunrise sector, too many players entered organized retail and same have

perished.

Entry of too many players: The hyped phase resulted in the entry of houses like Reliance,

Bharti, Aditya Birla Group, IndiaBulls, Mahindra, Godrej, DCM, Marico, Dabur, etc. with

already established players like Tata, RPG, Future Group, Raheja, etc. Most of the players

that entered the space had no prior experience in retailing nor were there any synergies

with their existing businesses. Many players just entered to create a footprint, which could

later be sold to foreign players in event of opening up of FDI in retail.

View on Future

Indian economy is expected to add another trillion dollars to its GDP in 5-6 years

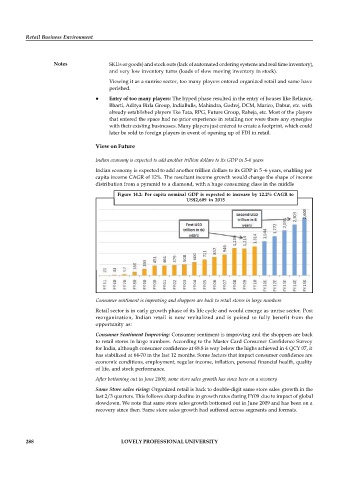

Indian economy is expected to add another trillion dollars to its GDP in 5 -6 years, enabling per

capita income CAGR of 12%. The resultant income growth would change the shape of income

distribution from a pyramid to a diamond, with a huge consuming class in the middle

Figure 14.2: Per capita nominal GDP is expected to increase by 12.2% CAGR to

US$2,609 in 2015

Consumer sentiment is improving and shoppers are back to retail stores in large numbers

Retail sector is in early growth phase of its life cycle and would emerge as unrise sector. Post

reorganization, Indian retail is now revitalized and is poised to fully benefit from the

opportunity as:

Consumer Sentiment Improving: Consumer sentiment is improving and the shoppers are back

to retail stores in large numbers. According to the Master Card Consumer Confidence Survey

for India, although consumer confidence at 68.8 is way below the highs achieved in 4 QCY 07, it

has stabilized at 64-70 in the last 12 months. Some factors that impact consumer confidence are

economic conditions, employment, regular income, inflation, personal financial health, quality

of life, and stock performance.

After bottoming out in June 2009, same store sales growth has since been on a recovery

Same Store sales rising: Organized retail is back to double-digit same store sales growth in the

last 2/3 quarters. This follows sharp decline in growth rates during FY09 due to impact of global

slowdown. We note that same store sales growth bottomed out in June 2009 and has been on a

recovery since then. Same store sales growth had suffered across segments and formats.

288 LOVELY PROFESSIONAL UNIVERSITY