Page 19 - DMGT513_DERIVATIVES_AND_RISK_MANAGEMENT

P. 19

Derivatives & Risk Management

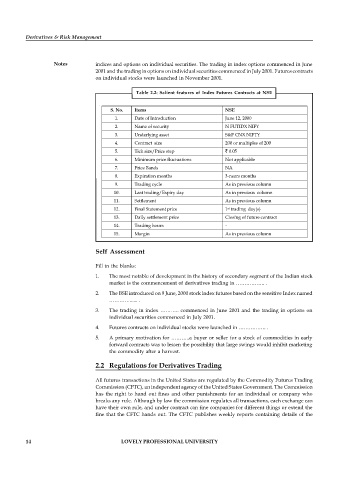

Notes indices and options on individual securities. The trading in index options commenced in June

2001 and the trading in options on individual securities commenced in July 2001. Futures contracts

on individual stocks were launched in November 2001.

Table 2.2: Salient features of Index Futures Contracts at NSE

S. No. Items NSE

1. Date of Introduction June 12, 2000

2. Name of security N FUTIDX NIFY

3. Underlying asset S&P CNX NIFTY

4. Contract size 200 or multiples of 200

5. Tick size/Price step 0.05

6. Minimum price fluctuations Not applicable

7. Price Bands NA

8. Expiration months 3-nears months

9. Trading cycle As in previous column

10. Last trading/Expiry day As in previous column

11. Settlement As in previous column

12. Final Statement price 1 trading day(s)

st

13. Daily settlement price Closing of future contract

14. Trading hours -

15. Margin As in previous column

Self Assessment

Fill in the blanks:

1. The most notable of development in the history of secondary segment of the Indian stock

market is the commencement of derivatives trading in …………….. .

2. The BSE introduced on 9 June, 2000 stock index futures based on the sensitive Index named

…………...... .

3. The trading in index ……….. commenced in June 2001 and the trading in options on

individual securities commenced in July 2001.

4. Futures contracts on individual stocks were launched in ……………. .

5. A primary motivation for ………..a buyer or seller for a stock of commodities in early

forward contracts was to lessen the possibility that large swings would inhibit marketing

the commodity after a harvest.

2.2 Regulations for Derivatives Trading

All futures transactions in the United States are regulated by the Commodity Futures Trading

Commission (CFTC), an independent agency of the United States Government. The Commission

has the right to hand out fines and other punishments for an individual or company who

breaks any rule. Although by law the commission regulates all transactions, each exchange can

have their own rule, and under contract can fine companies for different things or extend the

fine that the CFTC hands out. The CFTC publishes weekly reports containing details of the

14 LOVELY PROFESSIONAL UNIVERSITY