Page 96 - DMGT513_DERIVATIVES_AND_RISK_MANAGEMENT

P. 96

Unit 7: Option Strategies and Pay-offs

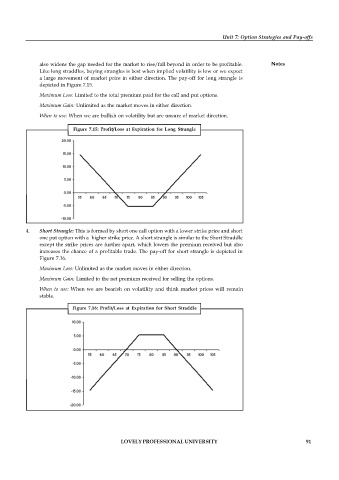

also widens the gap needed for the market to rise/fall beyond in order to be profitable. Notes

Like long straddles, buying strangles is best when implied volatility is low or we expect

a large movement of market price in either direction. The pay-off for long strangle is

depicted in Figure 7.15.

Maximum Loss: Limited to the total premium paid for the call and put options.

Maximum Gain: Unlimited as the market moves in either direction.

When to use: When we are bullish on volatility but are unsure of market direction.

Figure 7.15: Profit/Loss at Expiration for Long Strangle

4. Short Strangle: This is formed by short one call option with a lower strike price and short

one put option with a higher strike price. A short strangle is similar to the Short Straddle

except the strike prices are further apart, which lowers the premium received but also

increases the chance of a profitable trade. The pay-off for short strangle is depicted in

Figure 7.16.

Maximum Loss: Unlimited as the market moves in either direction.

Maximum Gain: Limited to the net premium received for selling the options.

When to use: When we are bearish on volatility and think market prices will remain

stable.

Figure 7.16: Profit/Loss at Expiration for Short Straddle

LOVELY PROFESSIONAL UNIVERSITY 91