Page 280 - DMGT514_MANAGEMENT_CONTROL_SYSTEMS

P. 280

Unit 14: Management Control of MNC’s

Notes

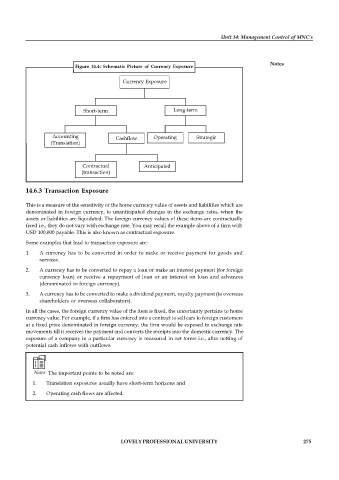

Figure 14.4: Schematic Picture of Currency Exposure

Currency Exposure

Short-term Long-term

Accounting Cashflow Operating Strategic

(Translation)

Contractual Anticipated

(transaction)

14.6.3 Transaction Exposure

This is a measure of the sensitivity of the home currency value of assets and liabilities which are

denominated in foreign currency, to unanticipated changes in the exchange rates, when the

assets or liabilities are liquidated. The foreign currency values of these items are contractually

fixed i.e., they do not vary with exchange rate. You may recall the example above of a firm with

USD 100,000 payable. This is also known as contractual exposure.

Some examples that lead to transaction exposure are:

1. A currency has to be converted in order to make or receive payment for goods and

services.

2. A currency has to be converted to repay a loan or make an interest payment (for foreign

currency loan) or receive a repayment of loan or an interest on loan and advances

(denominated in foreign currency).

3. A currency has to be converted to make a dividend payment, royalty payment (to overseas

shareholders or overseas collaborators).

In all the cases, the foreign currency value of the item is fixed, the uncertainty pertains to home

currency value. For example, if a firm has entered into a contract to sell cars to foreign customers

at a fixed price denominated in foreign currency, the firm would be exposed to exchange rate

movements till it receives the payment and converts the receipts into the domestic currency. The

exposure of a company in a particular currency is measured in net terms i.e., after netting of

potential cash inflows with outflows.

Notes The important points to be noted are:

1. Translation exposures usually have short-term horizons and

2. Operating cash flows are affected.

LOVELY PROFESSIONAL UNIVERSITY 275