Page 106 - DMGT515_PERSONAL_FINANCIAL_PLANNING

P. 106

Unit 6: Investment Strategies-I

6.1.1 Asset Classes Notes

There are three main types of asset classes – equities, fixed-income, and cash and equivalents.

The three asset classes have different levels of risk and return, so each will behave differently

over time.

Asset allocation refers to the way in which an investor weighs investments in their portfolio in

order to try to meet a specific objective.

Example: If your goal is to pursue growth (and you’re willing to take on market risk in

order to do so), you may decide to place 20% of your assets in bonds and 80% in stocks.

The asset classes you choose, and how you weight your investment in each, will probably hinge

on your investment time frame and how that matches with the risks and rewards of each asset

class.

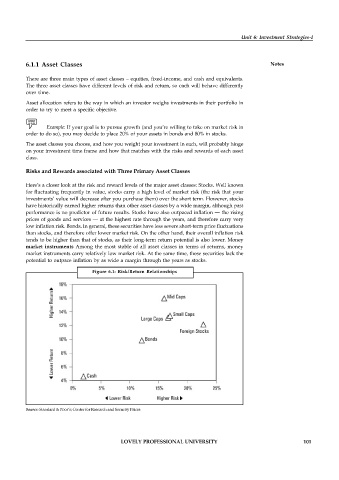

Risks and Rewards associated with Three Primary Asset Classes

Here’s a closer look at the risk and reward levels of the major asset classes: Stocks. Well known

for fluctuating frequently in value, stocks carry a high level of market risk (the risk that your

investments’ value will decrease after you purchase them) over the short term. However, stocks

have historically earned higher returns than other asset classes by a wide margin, although past

performance is no predictor of future results. Stocks have also outpaced inflation — the rising

prices of goods and services — at the highest rate through the years, and therefore carry very

low inflation risk. Bonds. In general, these securities have less severe short-term price fluctuations

than stocks, and therefore offer lower market risk. On the other hand, their overall inflation risk

tends to be higher than that of stocks, as their long-term return potential is also lower. Money

market instruments Among the most stable of all asset classes in terms of returns, money

market instruments carry relatively low market risk. At the same time, these securities lack the

potential to outpace inflation by as wide a margin through the years as stocks.

Figure 6.1: Risk/Return Relationships

Source: Standard & Poor’s; Center for Research and Security Prices

LOVELY PROFESSIONAL UNIVERSITY 101