Page 219 - DMGT547_INTERNATIONAL_MARKETING

P. 219

International Marketing

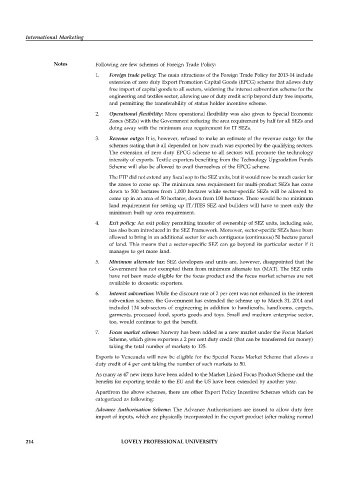

Notes Following are few schemes of Foreign Trade Policy:

1. Foreign trade policy: The main attractions of the Foreign Trade Policy for 2013-14 include

extension of zero duty Export Promotion Capital Goods (EPCG) scheme that allows duty

free import of capital goods to all sectors, widening the interest subvention scheme for the

engineering and textiles sector, allowing use of duty credit scrip beyond duty free imports,

and permitting the transferability of status holder incentive scheme.

2. Operational flexibility: More operational flexibility was also given to Special Economic

Zones (SEZs) with the Government reducing the area requirement by half for all SEZs and

doing away with the minimum area requirement for IT SEZs.

3. Revenue outgo: It is, however, refused to make an estimate of the revenue outgo for the

schemes stating that it all depended on how much was exported by the qualifying sectors.

The extension of zero duty EPCG scheme to all sectors will promote the technology

intensity of exports. Textile exporters benefiting from the Technology Upgradation Funds

Scheme will also be allowed to avail themselves of the EPCG scheme.

The FTP did not extend any fiscal sop to the SEZ units, but it would now be much easier for

the zones to come up. The minimum area requirement for multi-product SEZs has come

down to 500 hectares from 1,000 hectares while sector-specific SEZs will be allowed to

come up in an area of 50 hectares, down from 100 hectares. There would be no minimum

land requirement for setting up IT/ITES SEZ and builders will have to meet only the

minimum built up area requirement.

4. Exit policy: An exit policy permitting transfer of ownership of SEZ units, including sale,

has also been introduced in the SEZ Framework. Moreover, sector-specific SEZs have been

allowed to bring in an additional sector for each contiguous (continuous) 50 hectare parcel

of land. This means that a sector-specific SEZ can go beyond its particular sector if it

manages to get more land.

5. Minimum alternate tax: SEZ developers and units are, however, disappointed that the

Government has not exempted them from minimum alternate tax (MAT). The SEZ units

have not been made eligible for the focus product and the focus market schemes are not

available to domestic exporters.

6. Interest subvention: While the discount rate of 2 per cent was not enhanced in the interest

subvention scheme, the Government has extended the scheme up to March 31, 2014 and

included 134 sub-sectors of engineering in addition to handicrafts, handlooms, carpets,

garments, processed food, sports goods and toys. Small and medium enterprise sector,

too, would continue to get the benefit.

7. Focus market scheme: Norway has been added as a new market under the Focus Market

Scheme, which gives exporters a 2 per cent duty credit (that can be transferred for money)

taking the total number of markets to 125.

Exports to Venezuela will now be eligible for the Special Focus Market Scheme that allows a

duty credit of 4 per cent taking the number of such markets to 50.

As many as 47 new items have been added to the Market Linked Focus Product Scheme and the

benefits for exporting textile to the EU and the US have been extended by another year.

Apartfrom the above schemes, there are other Export Policy Incentive Schemes which can be

categorized as following:

Advance Authorisation Scheme: The Advance Authorisations are issued to allow duty free

import of inputs, which are physically incorporated in the export product (after making normal

214 LOVELY PROFESSIONAL UNIVERSITY