Page 64 - DMGT547_INTERNATIONAL_MARKETING

P. 64

Unit 3: Political Environment of International Marketing

In addition, there are several managerial strategies which are relevant. A firm may try to gain Notes

“cooperation” through long-term contractual agreements, alliances, interlocking directorates,

inter-firm personnel flows, etc. Furthermore, it may pursue product and geographic

diversification to gain “flexibility”. Also, operational flexibility can be achieved through flexible

input sourcing and multinational production.

!

Caution The rapid changes in Eastern Europe present both challenges and opportunities.

In the earlier days of centralisation, a trade minister in the capital could speak for the entire

nation but with decentralised decision making, an MNC has to go to many republics for

information and approval. Table 3.2 provides some tips for doing business in East Europe.

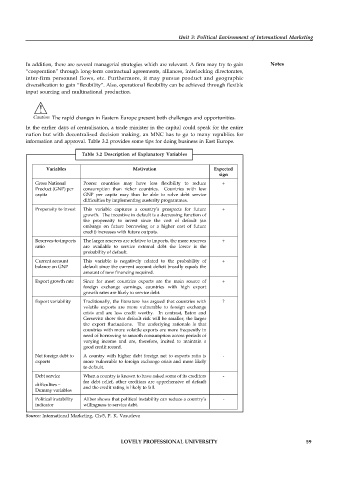

Table 3.2 Description of Explanatory Variables

Variables Motivation Expected

sign

Gross National Poorer countries may have less flexibility to reduce +

Product (GNP) per consumption than richer countries. Countries with low

capita GNP per capita may thus be able to solve debt service

difficulties by implementing austerity programmes.

Propensity to invest This variable captures a country’s prospects for future +

growth. The incentive in default is a decreasing function of

the propensity to invest since the cost of default (an

embargo on future borrowing or a higher cost of future

credit) increases with future outputs.

Reserves-to-imports The larger reserves are relative to imports, the more reserves +

ratio are available to service external debt the lower is the

probability of default.

Current account This variable is negatively related to the probability of +

balance on GNP default since the current account deficit broadly equals the

amount of new financing required.

Export growth rate Since for most countries exports are the main source of +

foreign exchange earnings, countries with high export

growth rates are likely to service debt.

Export variability Traditionally, the literature has argued that countries with ?

volatile exports are more vulnerable to foreign exchange

crisis and are less credit worthy. In contrast, Eaton and

Gersovitz show that default risk will be smaller, the larger

the export fluctuations. The underlying rationale is that

countries with more volatile exports are more frequently in

need of borrowing to smooth consumption across periods of

varying income and are, therefore, incited to maintain a

good credit record.

Net foreign debt to A country with higher debt foreign net to exports ratio is -

exports more vulnerable to foreign exchange crisis and more likely

to default.

Debt service When a country is known to have asked some of its creditors -

for debt relief, other creditors are apprehensive of default

difficulties – and the credit rating is likely to fall.

Dummy variables

Political instability Aliber shows that political instability can reduce a country’s -

indicator willingness to service debt.

Source: International Marketing, Ch-5, P. K. Vasudeva

LOVELY PROFESSIONAL UNIVERSITY 59