Page 118 - DMGT549_INTERNATIONAL_FINANCIAL_MANAGEMENT

P. 118

Unit 7: Management of Transaction Exposure

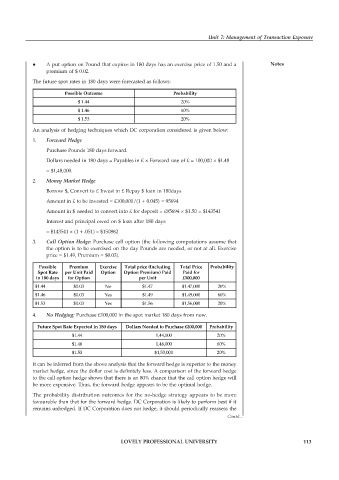

A put option on Pound that expires in 180 days has an exercise price of 1.50 and a Notes

premium of $ 0.02.

The future spot rates in 180 days were forecasted as follows:

Possible Outcome Probability

$ 1.44 20%

$ 1.46 60%

$ 1.53 20%

An analysis of hedging techniques which DC corporation considered is given below:

1. Forward Hedge

Purchase Pounds 180 days forward.

Dollars needed in 180 days = Payables in £ × Forward rate of £ = 100,000 × $1.48

= $1,48,000.

2. Money Market Hedge

Borrow $, Convert to £ Invest in £ Repay $ loan in 180days

Amount in £ to be invested = £100,000/(1 + 0.045) = 95694

Amount in $ needed to convert into £ for deposit = £95694 × $1.50 = $143541

Interest and principal owed on $ loan after 180 days

= $143541 × (1 + .051) = $150862

3. Call Option Hedge: Purchase call option (the following computations assume that

the option is to be exercised on the day Pounds are needed, or not at all. Exercise

price = $1.49, Premium = $0.03).

Possible Premium Exercise Total price (Including Total Price Probability

Spot Rate per Unit Paid Option Option Premium) Paid Paid for

in 180 days for Option per Unit £100,000

$1.44 $0.03 No $1.47 $1.47,000 20%

$1.46 $0.03 Yes $1.49 $1,49,000 60%

$1.53 $0.03 Yes $1.56 $1,56,000 20%

4. No Hedging: Purchase £100,000 in the spot market 180 days from now.

Future Spot Rate Expected in 180 days Dollars Needed to Purchase £200,000 Probability

$1.44 1,44,000 20%

$1.46 1,46,000 60%

$1.53 $1,53,000 20%

It can be inferred from the above analysis that the forward hedge is superior to the money

market hedge, since the dollar cost is definitely less. A comparison of the forward hedge

to the call option hedge shows that there is an 80% chance that the call option hedge will

be more expensive. Thus, the forward hedge appears to be the optimal hedge.

The probability distribution outcomes for the no-hedge strategy appears to be more

favourable than that for the forward hedge. DC Corporation is likely to perform best if it

remains unhedged. If DC Corporation does not hedge, it should periodically reassess the

Contd...

LOVELY PROFESSIONAL UNIVERSITY 113