Page 147 - DMGT549_INTERNATIONAL_FINANCIAL_MANAGEMENT

P. 147

International Financial Management

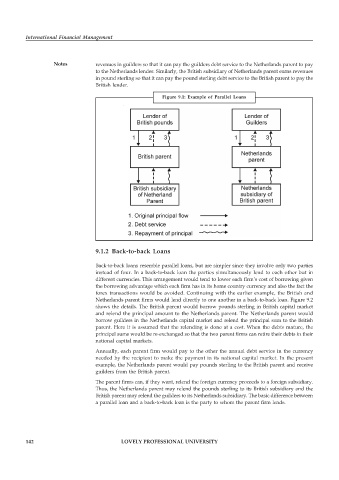

Notes revenues in guilders so that it can pay the guilders debt service to the Netherlands parent to pay

to the Netherlands lender. Similarly, the British subsidiary of Netherlands parent earns revenues

in pound sterling so that it can pay the pound sterling debt service to the British parent to pay the

British lender.

Figure 9.1: Example of Parallel Loans

9.1.2 Back-to-back Loans

Back-to-back loans resemble parallel loans, but are simpler since they involve only two parties

instead of four. In a back-to-back loan the parties simultaneously lend to each other but in

different currencies. This arrangement would tend to lower each firm’s cost of borrowing given

the borrowing advantage which each firm has in its home country currency and also the fact the

forex transactions would be avoided. Continuing with the earlier example, the British and

Netherlands parent firms would lend directly to one another in a back-to-back loan. Figure 9.2

shows the details. The British parent would borrow pounds sterling in British capital market

and relend the principal amount to the Netherlands parent. The Netherlands parent would

borrow guilders in the Netherlands capital market and relend the principal sum to the British

parent. Here it is assumed that the relending is done at a cost. When the debts mature, the

principal sums would be re-exchanged so that the two parent firms can retire their debts in their

national capital markets.

Annually, each parent firm would pay to the other the annual debt service in the currency

needed by the recipient to make the payment in its national capital market. In the present

example, the Netherlands parent would pay pounds sterling to the British parent and receive

guilders from the British parent.

The parent firms can, if they want, relend the foreign currency proceeds to a foreign subsidiary.

Thus, the Netherlands parent may relend the pounds sterling to its British subsidiary and the

British parent may relend the guilders to its Netherlands subsidiary. The basic difference between

a parallel loan and a back-to-back loan is the party to whom the parent firm lends.

142 LOVELY PROFESSIONAL UNIVERSITY