Page 156 - DMGT549_INTERNATIONAL_FINANCIAL_MANAGEMENT

P. 156

Unit 9: Interest Rate and Currency Swaps

11. In an extendible swap, the fixed rate payer gets the right to extend the swap maturity date. Notes

12. The interest rate swap involves the exchange of principal amounts.

9.5 Currency Swaps

A currency swap is a contract to exchange interest payments in one currency for those denominated

in another currency. The currency swap developed from back-to-back loans and parallel loans

and also functions virtually in the same manner. At present, the currency swap market, although

older than the interest rate market, is smaller and less sophisticated.

A standard currency swap entails the exchange of debt denominated in one currency for debt

denominated in another currency. Consider an example. Assume that a US multinational company

wants to issue a yen denominated bond so that it can make payments with yen inflows generated

by a Japanese subsidiary. Also, suppose there exists a Japanese multinational that wants to issue

dollar denominated debt. The US multinational could issue dollar debt while the Japanese

multinational issues yen debt. The US MNC would then provide yen payment, both principal

and interest to Japanese MNC in exchange for dollar payment. The swap of currencies allows the

two MNCs to make payments to their respective debt holders without having to repatriate

foreign exchange.

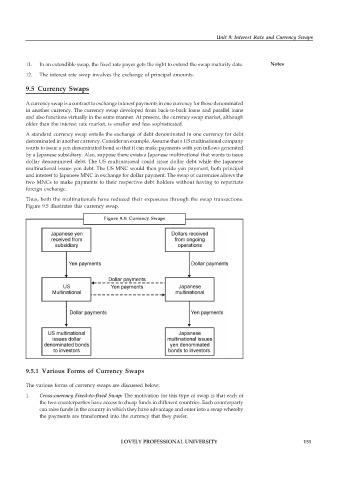

Thus, both the multinationals have reduced their exposures through the swap transactions.

Figure 9.5 illustrates this currency swap.

Figure 9.5: Currency Swaps

9.5.1 Various Forms of Currency Swaps

The various forms of currency swaps are discussed below:

1. Cross-currency Fixed-to-fixed Swap: The motivation for this type of swap is that each of

the two counterparties have access to cheap funds in different countries. Each counterparty

can raise funds in the country in which they have advantage and enter into a swap whereby

the payments are transformed into the currency that they prefer.

LOVELY PROFESSIONAL UNIVERSITY 151