Page 155 - DMGT207_MANAGEMENT_OF_FINANCES

P. 155

Management of Finances

Notes

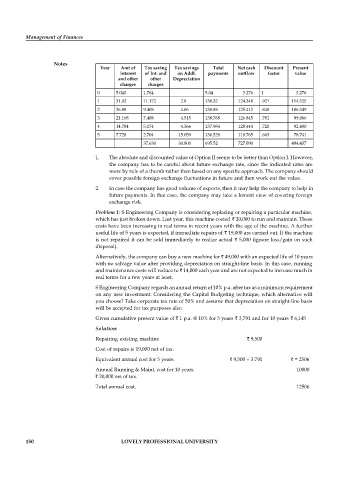

Year Amt of Tax saving Tax savings Total Net cash Discount Present

interest of Int. and on Addl. payments outflow factor value

and other other Depreciation

charges charges

0 5.040 1.764 5.04 3.276 1 3.276

1 31.92 11.172 2.8 138.32 124.348 .921 114.525

2 26.88 9.408 4.06 138.88 125.412 .848 106.349

3 21.168 7.408 4.515 138.768 126.845 .781 99.066

4 14.784 5.174 4.366 137.984 128.444 .720 92.480

5 7.728 2.704 15.059 136.528 118.765 .663 78.741

37.630 30.800 695.52 727.090 494.437

1. The absolute and discounted value of Option II seems to be better than Option I. However,

the company has to be careful about future exchange rate, since the indicated rates are

more by rule of a thumb rather than based on any specific approach. The company should

cover possible foreign exchange fluctuations in future and then work out the value.

2. In case the company has good volume of exports, then it may help the company to help in

future payments. In that case, the company may take a lenient view of covering foreign

exchange risk.

Problem 1: S Engineering Company is considering replacing or repairing a particular machine,

which has just broken down. Last year, this machine costed 20,000 to run and maintain. These

costs have been increasing in real terms in recent years with the age of the machine. A further

useful life of 5 years is expected, if immediate repairs of 19,000 are carried out. If the machine

is not repaired it can be sold immediately to realize actual 5,000 (ignore loss/gain on such

disposal).

Alternatively, the company can buy a new machine for 49,000 with an expected life of 10 years

with no salvage value after providing depreciation on straight-line basis. In this case, running

and maintenance costs will reduce to 14,000 each year and are not expected to increase much in

real terms for a few years at least.

S Engineering Company regards an annual return of 10% p.a. after tax as a minimum requirement

on any new investment. Considering the Capital Budgeting technique, which alternative will

you choose? Take corporate tax rate of 50% and assume that depreciation on straight-line basis

will be accepted for tax purposes also.

Given cumulative present value of 1 p.a. @ 10% for 5 years 3,791 and for 10 years 6,145

Solution:

Repairing existing machine 9,500

Cost of repairs is 19,000 net of tax.

Equivalent annual cost for 5 years. 9,500 3.791 = 2506

Annual Running & Maint. cost for 10 years 10000

20,000 net of tax.

Total annual cost. 12506

150 LOVELY PROFESSIONAL UNIVERSITY