Page 151 - DMGT207_MANAGEMENT_OF_FINANCES

P. 151

Management of Finances

Notes Incremental cash inflow per year 15,000

Capital investment:

Cost of the new machine 2,60,000

Sale proceeds of old machine (–) 1,30,000

Tax on account of sale of old machine:

Sale proceeds 1,30,000

Depreciated value 160,000 – 5 × 10,000 1,10,000

40% tax 20,000 8,000

Reduction in Working Capital (–) 20,000 118,000

Inflow:

Saving from operations 1 - 10 years @ 15,000 × 5,650 84,750

Sale proceeds at 10th year 10,000 × 0.322 3,220

Reduction in working capital

restored at the end of the project 20,000 × 0.322 (–) 6.440 81,530

Net Present Value (-) 36,470

Since the net present value is negative, the new machine should not be purchased.

Problem 5: A company is setting up a project at a cost of 300 lakhs. It has to decide whether to

locate the plant in a Forward Area (FA) or Backward Area (BA). Locating in Backward area

means a cash subsidy of 15 lakhs from the Central Govt. Besides, the taxable profits to the

extent of 20% is exempt for 10 years. The project envisages a borrowing of 200 lakhs in either

case.

The cost of borrowing will be 12% in Forward Area and 10% in Backward Area; costs are bound

to be higher in Backward Area. However, the revenue costs are bound to be higher in Backward

Area. The borrowings (principal) have to be repaid in 4 equal annual installments beginning

from the end of the 4th year.

With the help of following information and by using DCF technique you are required to suggest

the proper location of the project. Assume straight-line depreciation with no residual value.

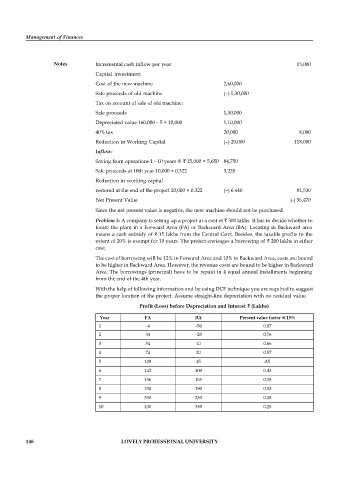

Profit (Loss) before Depreciation and Interest (Lakhs)

Year FA BA Present value factor @ 15%

1 –6 –50 0.87

2 34 –20 0.76

3 54 10 0.66

4 74 20 0.57

5 108 45 0.5

6 142 100 0.43

7 156 155 0.38

8 230 190 0.33

9 330 230 0.28

10 430 330 0.25

146 LOVELY PROFESSIONAL UNIVERSITY