Page 401 - DECO401_MICROECONOMIC_THEORY_ENGLISH

P. 401

Microeconomic Theory

Notes

Fig. 28.2

Risk Loving

TU

D

20

Utility 12 C

10 B

A

4

0

5000 10000 12000 15000 Income (`)

Uncertain odds (12) the expected utility is more than the certain odds (10) the expected utility, means

12 > 10. So this man will prefer (the expected utility 12) with uncertain odds like gamble more than

(the expected utility 10) with certain odds. This is the gamble of the TU curve win two utility level

game ` 12,000. So the risk loving man will play for his certain odds (` 10,000) and above ` 2,000

(` 12,000 – ` 10,000).

Risk Averse

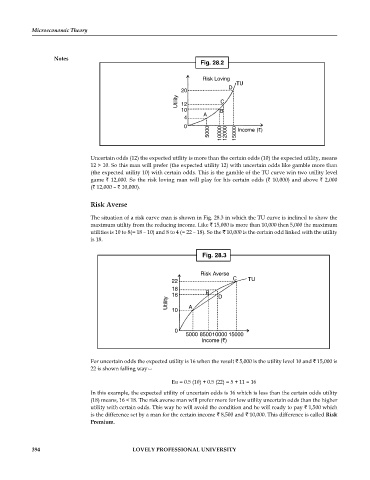

The situation of a risk curve man is shown in Fig. 28.3 in which the TU curve is inclined to show the

maximum utility from the reducing income. Like 15,000 is more than 10,000 then 5,000 the maximum

utilities is 10 to 8(= 18 – 10) and 8 to 4 (= 22 – 18). So the 10,000 is the certain odd linked with the utility

is 18.

Fig. 28.3

Risk Averse

C TU

22

18

16 B D

Utility

10 A

0

5000 850010000 15000

Income (`)

For uncertain odds the expected utility is 16 when the result 5,000 is the utility level 10 and 15,000 is

22 is shown falling way—

Eu = 0.5 (10) + 0.5 (22) = 5 + 11 = 16

In this example, the expected utility of uncertain odds is 16 which is less than the certain odds utility

(18) means, 16 < 18. The risk averse man will prefer more for low utility uncertain odds than the higher

utility with certain odds. This way he will avoid the condition and he will ready to pay 1,500 which

is the difference set by a man for the certain income 8,500 and 10,000. This difference is called Risk

Premium.

394 LOVELY PROFESSIONAL UNIVERSITY