Page 158 - DECO402_Macro Economics

P. 158

Unit-17: Money Multiplier and Credit Creation by Commercial Banks

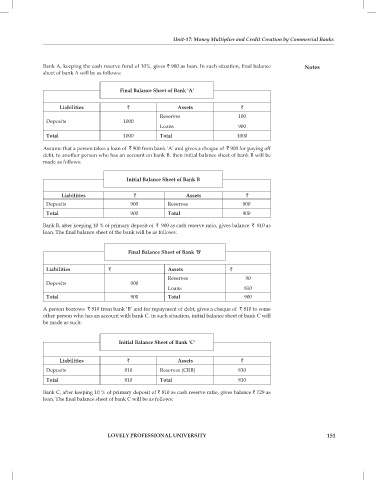

Bank A, keeping the cash reserve fund of 10%, gives ` 900 as loan. In such situation, final balance Notes

sheet of bank A will be as follows:

Final Balance Sheet of Bank 'A'

Liabilities ` Assets `

Reserves 100

Deposits 1000

Loans 900

Total 1000 Total 1000

Assume that a person takes a loan of ` 900 from bank ‘A’ and gives a cheque of ` 900 for paying off

debt, to another person who has an account on bank B. then initial balance sheet of bank B will be

made as follows:

Initial Balance Sheet of Bank B

Liabilities ` Assets `

Deposits 900 Reserves 900

Total 900 Total 900

Bank B, after keeping 10 % of primary deposit of ` 900 as cash reserve ratio, gives balance ` 810 as

loan. The final balance sheet of the bank will be as follows:

Final Balance Sheet of Bank 'B'

Liabilities ` Assets `

Reserves 90

Deposits 900

Loans 810

Total 900 Total 900

A person borrows ` 810 from bank ‘B’ and for repayment of debt, gives a cheque of ` 810 to some

other person who has an account with bank C. in such situation, initial balance sheet of bank C will

be made as such:

Initial Balance Sheet of Bank 'C'

Liabilities ` Assets `

Deposits 810 Reserves (CRR) 810

Total 810 Total 810

Bank C, after keeping 10 % of primary deposit of ` 810 as cash reserve ratio, gives balance ` 729 as

loan. The final balance sheet of bank C will be as follows:

LOVELY PROFESSIONAL UNIVERSITY 151