Page 33 - DECO402_Macro Economics

P. 33

Macroeconomic Theory

Notes In gross national disposable income, current replacement cost is included whereas in net disposable

income (in short disposable income), it is not included.

What is current Replacement cost?

This is by a country using in a year, property become useless their replacement cost. This is

depreciation cost (or consumption of permanent capital) of whole economy.

Net National Disposable Income (in short, disposable income) = Gross national disposable

income – Current replacement cost (which is depreciation at whole economy level)

Task Express your views on total related aggregates.

2.4 Components of National Disposable Income

National disposable income is estimated by following types:

National disposable income = Net domestic product at factor cost (or domestic income) + net indirect

tax + net factor income from abroad + receipts net current transfers from rest of the world

Difference between Personal Disposable Income and National Disposable Income

(i) Personal disposable income relationship is only a nations’s residents and households’

disposable income, whereas national disposable income relationship is whole country’s

disposable income.

(ii) For estimation of national disposable income, net domestic product at factor cost, net

indirect tax, net factor income accuring from abroad, and net current transfer accruing from

rest of the world is added. On the other hand in personal disposable income, a country’s

domestic consumption and domestic savings are added.

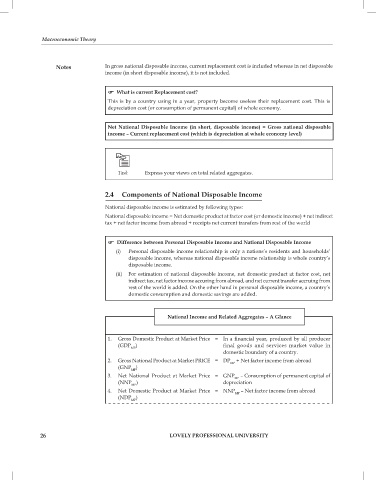

National Income and Related Aggregates – A Glance

1. Gross Domestic Product at Market Price = In a financial year, produced by all producer

(GDP ) final goods and services market value in

MP

domestic boundary of a country.

2. Gross National Product at Market PRICE = DP + Net factor income from abroad

MP

(GNP )

MP

3. Net National Product at Market Price = GNP – Consumption of permanent capital of

MP

(NNP ) depreciation

MP

4. Net Domestic Product at Market Price = NNP – Net factor income from abroad

MP

(NDP )

MP

26 LOVELY PROFESSIONAL UNIVERSITY