Page 46 - DECO402_Macro Economics

P. 46

Unit-4: Sectorial Accounting

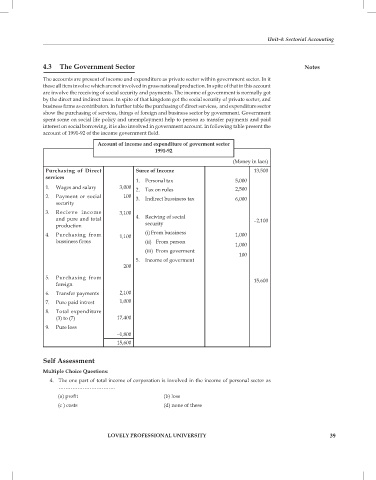

4.3 The Government Sector Notes

The accounts are present of income and expenditure as private sector within government sector. In it

those all item involve which are not involved in gross national production. In spite of that in this account

are involve the receiving of social security and payments. The income of government is normally got

by the direct and indirect taxes. In spite of that kingdom got the social security of private sector, and

business firms as contributon. In further table the purchasing of direct services, and expenditure sector

show the purchasing of services, things of foreign and business sector by government. Government

spent some on social life policy and unemployment help to person as transfer payments and paid

interest on social borrowing, it is also involved in government account. In following table present the

account of 1991-92 of the income government field.

Account of income and expenditure of goverment sector

1991-92

(Money in lacs)

Purchasing of Direct Surce of Income 13,500

services

1. Personal tax 5,000

1. Wages and salary 3,000 2. Tax on rules 2,500

2. Payment or social 100 3. Indirect bussiness tax 6,000

security

3. Recieve income 3,100

and pure and total 4. Reciving of social –2,100

production security

4. Purchasing from 1,100 (i) From bussiness 1,000

bussiness firms (ii) From person

1,000

(iii) From goverment 100

5. Income of goverment

200

5. Purchasing from 15,600

foreign

6. Transfer payments 2,100

7. Pure paid intrest 1,000

8. Total expenditure

(3) to (7) 17,400

9. Pure loss

–1,800

15,600

Self Assessment

Multiple Choice Questions:

4. The one part of total income of corporation is involved in the income of personal sector as

……………………………

(a) profit (b) loss

(c ) costs (d) none of these

LOVELY PROFESSIONAL UNIVERSITY 39