Page 294 - DECO502_INDIAN_ECONOMIC_POLICY_ENGLISH

P. 294

Indian Economic Policy

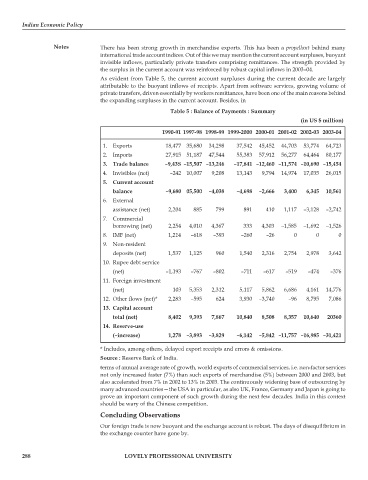

Notes There has been strong growth in merchandise exports. This has been a propellant behind many

international trade account indices. Out of this we may mention the current account surpluses, buoyant

invisible inflows, particularly private transfers comprising remittances. The strength provided by

the surplus in the current account was reinforced by robust capital inflows in 2003–04.

As evident from Table 5, the current account surpluses during the current decade are largely

attributable to the buoyant inflows of receipts. Apart from software services, growing volume of

private transfers, driven essentially by workers remittances, have been one of the main reasons behind

the expanding surpluses in the current account. Besides, in

Table 5 : Balance of Payments : Summary

(in US $ million)

1990-91 1997-98 1998-99 1999-2000 2000-01 2001-02 2002-03 2003-04

1. Exports 18,477 35,680 34,298 37,542 45,452 44,703 53,774 64,723

2. Imports 27,915 51,187 47,544 55,383 57,912 56,277 64,464 80,177

3. Trade balance –9,43S –15,507 –13,246 –17,841 –12,460 –11,574 –10,690 –15,454

4. Invisibles (net) –242 10,007 9,208 13,143 9,794 14,974 17,035 26,015

5. Current account

balance –9,680 05,500 –4,038 –4,698 –2,666 3,400 6,345 10,561

6. External

assistance (net) 2,204 885 799 891 410 1,117 –3,128 –2,742

7. Commercial

borrowing (net) 2,254 4,010 4,367 333 4,303 –1,585 –1,692 –1,526

8. IMF (net) 1,214 –618 –393 –260 –26 0 0 0

9. Non-resident

deposits (net) 1,537 1,125 960 1,540 2,316 2,754 2,978 3,642

10. Rupee debt service

(net) –1,193 –767 –802 –711 –617 –519 –474 –376

11. Foreign investment

(net) 103 5,353 2,312 5,117 5,862 6,686 4,161 14,776

12. Other flows (net)* 2,283 –595 624 3,930 –3,740 –96 8,795 7,086

13. Capital account

total (net) 8,402 9,393 7,867 10,840 8,508 8,357 10,640 20360

14. Reserve-use

(–increase) 1,278 –3,893 –3,829 –6,142 –5,842 –11,757 –16,985 –31,421

* Includes, among others, delayed export receipts and errors & omissions.

Source : Reserve Bank of India.

terms of annual average rate of growth, world exports of commercial services, i.e. non-factor services

not only increased faster (7%) than such exports of merchandise (5%) between 2000 and 2003, but

also accelerated from 7% in 2002 to 13% in 2003. The continuously widening base of outsourcing by

many advanced countries—the USA in particular, as also UK, France, Germany and Japan is going to

prove an important component of such growth during the next few decades. India in this context

should be wary of the Chinese competition.

Concluding Observations

Our foreign trade is now buoyant and the exchange account is robust. The days of disequilibrium in

the exchange counter have gone by.

288 LOVELY PROFESSIONAL UNIVERSITY