Page 168 - DECO503_INTERNATIONAL_TRADE_AND_FINANCE_ENGLISH

P. 168

International Trade and Finance

Notes

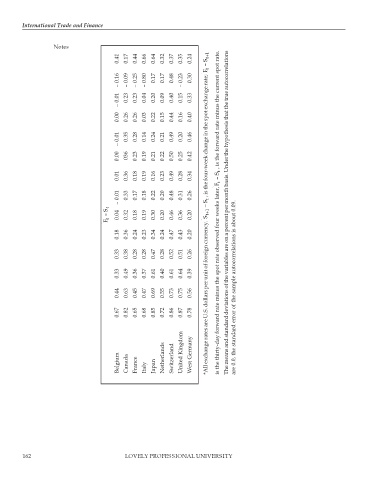

0.41 0.17 0.44 0.66 0.64 0.32 0.37 0.35 0.24 +1 t

t

– 0.16 – 0.09 – 0.25 – 0.80 0.17 0.17 0.48 – 0.23 0.30

– 0.01 0.23 0.23 0.04 0.20 0.09 0.40 0.15 0.33

0.00 0.26 0.26 0.03 0.22 0.15 0.44 0.16 0.40 , is the forward rate minus the current spot rate.

– 0.01 0.35 0.28 0.14 0.24 0.21 0.49 0.20 0.46 , is the four-week change in the spot exchange rate; F – S

0.00 036 0.23 0.19 0.21 0.22 0.50 0.25 0.42

0.01 0.36 0.18 0.19 0.16 0.23 0.49 0.28 0.34 t

t

– 0.01 0.33 0.17 0.18 0.22 0.20 0.48 0.31 0.26 t

t − S

F – S

0.04 0.32 0.18 0.19 0.30 0.20 0.46 0.36 0.20 t1 + The means and standard deviations of the variables are on a percent per month basis. Under the hypothesis that the true autocorrelations

t

0.18 0.36 0.24 0.23 0.34 0.24 0.47 0.43 0.20

0.33 0.38 0.28 0.28 0.47 0.28 0.52 0.51 0.26

0.33 0.49 0.36 0.37 0.61 0.40 0.61 0.64 0.39 is the thirty-day forward rate minus the spot rate observed four weeks later, F – S

0.44 0.63 0.45 0.47 0.69 0.55 0.73 0.75 0.56 *All exchange rates are U.S. dollars per unit of foreign currency. S are 0.0, the standard error of the sample autocorrelations is about 0.09.

0.67 0.82 0.65 0.68 0.85 0.72 0.86 0.87 0.78

Belgium Canada France Italy Japan Netherlands Switzerland United Kingdom West Germany

162 LOVELY PROFESSIONAL UNIVERSITY