Page 170 - DCOM101_FINANCIAL_ACCOUNTING_I

P. 170

Financial Accounting-I

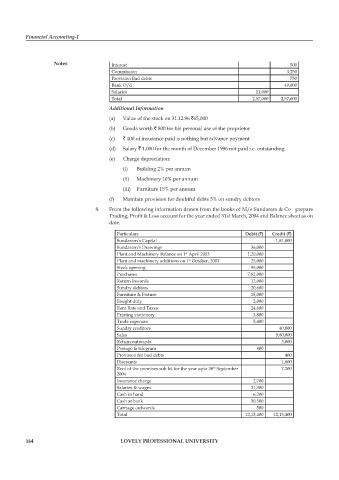

Notes Interest 500

Commission 3,250

Provision Bad debts 750

Bank O/d 40,000

Salaries 11,000

Total 2,57,000 2,57,000

Additional Information

(a) Value of the stock on 31.12.96 `65,000

(b) Goods worth ` 800 for his personal use of the proprietor

(c) ` 400 of insurance paid is nothing but advance payment

(d) Salary ` 1,000 for the month of December 1996 not paid i.e. outstanding

(e) Charge depreciation:

(i) Building 2% per annum

(ii) Machinery 10% per annum

(iii) Furniture 15% per annum

(f) Maintain provision for doubtful debts 5% on sundry debtors

8. From the following information drawn from the books of M/s Sundaram & Co prepare

Trading, Profit & Loss account for the year ended 31st March, 2004 and Balance sheet as on

date.

Particulars Debit (`) Credit (`)

Sundaram’s Capital 1,81,000

Sundaram’s Drawings 36,000

st

Plant and Machinery Balance on 1 April 2003 1,20,000

Plant and machinery additions on 1 October, 2003 25,000

st

Stock opening 95,000

Purchases 7,82,000

Return Inwards 12,000

Sundry debtors 20,600

Furniture & Fixture 15,000

Freight duty 2,000

Rent Rate and Taxes 24,600

Printing stationery 3,800

Trade expenses 5,400

Sundry creditors 40,000

Sales 9,80,000

Return outwards 3,000

Postage & telegram 800

Provision for bad debts 400

Discounts 1,800

Rent of the premises sub let for the year upto 30 September 7,200

th

2004

Insurance charge 2,700

Salaries & wages 31,300

Cash in hand 6,200

Cash at bank 30,500

Carriage outwards 500

Total 12,13,400 12,13,400

164 LOVELY PROFESSIONAL UNIVERSITY