Page 165 - DCOM101_FINANCIAL_ACCOUNTING_I

P. 165

Unit 12: Final Accounts

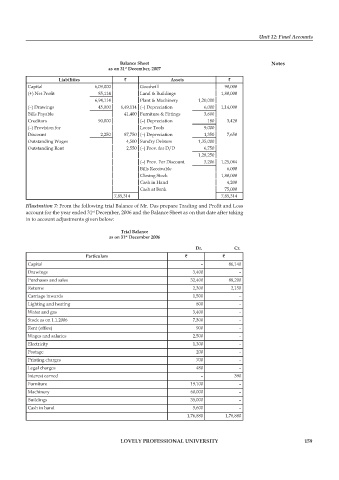

Balance Sheet Notes

as on 31 December, 2007

st

Liabilities ` Assets `

Capital 6,09,000 Goodwill 90,000

(+) Net Profit 85,114 Land & Buildings 1,80,000

6,94,114 Plant & Machinery 1,20,000

(–) Drawings 45,000 6,49,114 (–) Depreciation 6,000 1,14,000

Bills Payable 41,400 Furniture & Fittings 3,600

Creditors 90,000 (–) Depreciation 180 3,420

(–) Provision for Loose Tools 9,000

Discount 2,250 87,750 (–) Depreciation 1,350 7,650

Outstanding Wages 4,500 Sundry Debtors 1,35,000

Outstanding Rent 2,550 (–) Prov. for D/D 6,750

1,28,250

(–) Prov. For Discount 3,206 1,25,044

Bills Receivable 6,000

Closing Stock 1,80,000

Cash in Hand 4,200

Cash at Bank 75,000

7,85,314 7,85,314

Illustration 7: From the following trial Balance of Mr. Das prepare Trading and Profit and Loss

account for the year ended 31 December, 2006 and the Balance Sheet as on that date after taking

st

in to account adjustments given below:

Trial Balance

as on 31 December 2006

st

Dr. Cr.

Particulars ` `

Capital – 86,140

Drawings 3,400 –

Purchases and sales 32,400 88,200

Returns 2,300 2,150

Carriage inwards 1,500 –

Lighting and heating 800 –

Water and gas 3,400 –

Stock as on 1.1.2006 7,300 –

Rent (offi ce) 900 –

Wages and salaries 2,500 –

Electricity 1,300 –

Postage 200 –

Printing charges 700 –

Legal charges 480 –

Interest earned – 390

Furniture 19,100 –

Machinery 60,000 –

Buildings 35,000 –

Cash in hand 5,600 –

1,76,880 1,76,880

LOVELY PROFESSIONAL UNIVERSITY 159