Page 163 - DCOM101_FINANCIAL_ACCOUNTING_I

P. 163

Unit 12: Final Accounts

14. Goods distributed as free samples/charity: It may be debited in the goods sent as free Notes

samples or Advertisement account and credited to Purchases Account. The following

journal entry will be passed:

Goods sent as free sample A/c Dr

To Purchases A/c

15. Provision for Income Tax/advance tax: Provision for Income-tax is made based on

estimation and accordingly Advance Tax would have been paid. `Provision for Income-

Tax` would appear in Current liabilities and `Advance Tax` will appear under Advances in

Current Assets. Both the accounts can be adjusted once the tax is assessed and the return is

filed. If the provision made in the books is lesser, additional tax liability will be booked as

expenditure and if the Advance Tax paid is more than the provision, the excess paid will

continue to be shown under current Assets till the receipt of refund. So once the final tax is

ascertained, both the accounts will be given effect and adjusted.

12.6 Final Accounts with Adjustments

The given below are the examples explaining the preparation of final accounts with

adjustments:

st

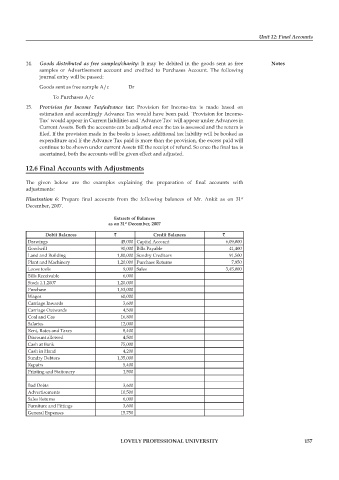

Illustration 6: Prepare final accounts from the following balances of Mr. Ankit as on 31

December, 2007.

Extracts of Balances

st

as on 31 December, 2007

Debit Balances ` Credit Balances `

Drawings 45,000 Capital Account 6,09,000

Goodwill 90,000 Bills Payable 41,400

Land and Building 1,80,000 Sundry Creditors 91,500

Plant and Machinery 1,20,000 Purchase Returns 7,950

Loose tools 9,000 Sales 3,45,000

Bills Receivable 6,000

Stock 1.1.2007 1,20,000

Purchase 1,53,000

Wages 60,000

Carriage Inwards 3,600

Carriage Outwards 4,500

Coal and Gas 16,800

Salaries 12,000

Rent, Rates and Taxes 8,400

Discount allowed 4,500

Cash at Bank 75,000

Cash in Hand 4,200

Sundry Debtors 1,35,000

Repairs 5,400

Printing and Stationery 1,500

Bad Debts 3,600

Advertisements 10,500

Sales Returns 6,000

Furniture and Fittings 3,600

General Expenses 15,750

LOVELY PROFESSIONAL UNIVERSITY 157