Page 161 - DCOM101_FINANCIAL_ACCOUNTING_I

P. 161

Unit 12: Final Accounts

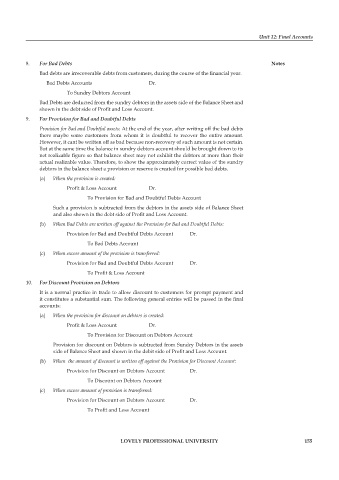

8. For Bad Debts Notes

Bad debts are irrecoverable debts from customers, during the course of the fi nancial year.

Bad Debts Accounts Dr.

To Sundry Debtors Account

Bad Debts are deducted from the sundry debtors in the assets side of the Balance Sheet and

shown in the debt side of Profit and Loss Account.

9. For Provision for Bad and Doubtful Debts

Provision for Bad and Doubtful assets: At the end of the year, after writing off the bad debts

there maybe some customers from whom it is doubtful to recover the entire amount.

However, it cant be written off as bad because non-recovery of such amount is not certain.

But at the same time the balance in sundry debtors account should be brought down to its

net realizable figure so that balance sheet may not exhibit the debtors at more than their

actual realizable value. Therefore, to show the approximately correct value of the sundry

debtors in the balance sheet a provision or reserve is created for possible bad debts.

(a) When the provision is created:

Profit & Loss Account Dr.

To Provision for Bad and Doubtful Debts Account

Such a provision is subtracted from the debtors in the assets side of Balance Sheet

and also shown in the debt side of Profit and Loss Account.

(b) When Bad Debts are written off against the Provision for Bad and Doubtful Debts:

Provision for Bad and Doubtful Debts Account Dr.

To Bad Debts Account

(c) When excess amount of the provision is transferred:

Provision for Bad and Doubtful Debts Account Dr.

To Profit & Loss Account

10. For Discount Provision on Debtors

It is a normal practice in trade to allow discount to customers for prompt payment and

it constitutes a substantial sum. The following general entries will be passed in the fi nal

accounts:

(a) When the provision for discount on debtors is created:

Profit & Loss Account Dr.

To Provision for Discount on Debtors Account

Provision for discount on Debtors is subtracted from Sundry Debtors in the assets

side of Balance Sheet and shown in the debit side of Profit and Loss Account.

(b) When the amount of discount is written off against the Provision for Discount Account:

Provision for Discount on Debtors Account Dr.

To Discount on Debtors Account

(c) When excess amount of provision is transferred:

Provision for Discount on Debtors Account Dr.

To Profit and Loss Account

LOVELY PROFESSIONAL UNIVERSITY 155